With 475 companies (96% of market capitalization) of the S&P 500 index having reported 4Q 2022 results, the earnings season is officially drawing to a close. As expected, 4Q 2022 was the first quarter to record negative year-over-year earnings growth since 3Q 2020, with earnings declining by 4.9% compared to the same quarter a year ago. This happened despite revenues growing at a healthy 5.4% clip over the same period, thanks in part to a still strong economy and in part to inflation. Such divergence between earnings and revenues is explained by a contraction in profit margins, which fell to 11.2% from 12.4% a year ago but remain historically elevated. The message is clear: companies were no longer able to fully pass on higher input costs to customers, which ate into their bottom line. The most extreme example of this dynamic came from retailers such as Target and Kohl’s, which had to actually mark down prices on some items to reduce bloated inventory levels.

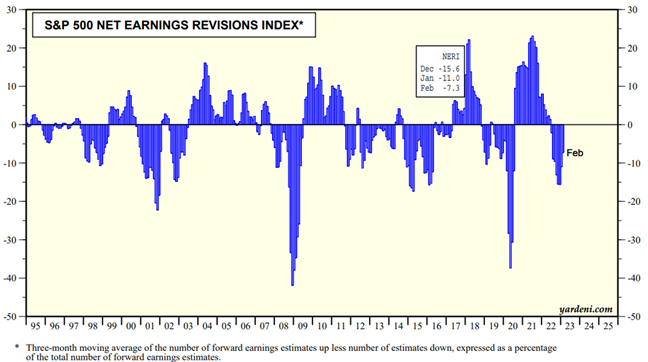

As always, the most interesting and useful piece of information coming out of earnings season is company guidance, because it informs us on what to expect going forward, as opposed to what has already happened. Of the 97 companies in the S&P 500 index that issued earnings guidance for 1Q 2023, 78% guided analysts lower, which is significantly higher than the five-year average of 59%. So, executives remain cautious in their outlooks, but apparently not as much as feared. This is evident from the market’s reaction to companies that reported negative earnings surprises, which saw price decrease of just -0.6% on average compared to -2.2% on average over the last five years. It is also evident from the improvement in the net earnings revisions index (NERI) for the S&P 500 index, which remains negative but started trending higher in January and February after bottoming in December. The index is calculated as the spread between the number of positive revisions and the number of negative revisions over the same period, and the recent improvement indicates that analysts are no longer slashing their earnings estimates as aggressively as they did at the end of last year. Major bottoms in the NERI have historically led to major bottoms in stock prices.

So, what should we expect going forward? Consensus estimates call for earnings weakness to persist through the first half of 2023, with 1Q and 2Q earnings expected to come in 5.7% and 3.7% lower than the same quarter last year, respectively. On a calendar year basis, earnings estimates for both 2023 and 2024 have already been revised down by roughly 11%. These declines are already priced into current market prices, so the key going forward will be whether actual results come in better or worse than expected. Over the near term, with the economy appearing to be much more resilient than expected (the Atlanta Fed GDPNow model is currently forecasting 2.8% GDP growth in 1Q 2023), earnings revisions are likely to continue to trend higher, which would be well received by the market. Longer term, recession risks remain elevated, and if one does come to pass then earnings estimates will likely take another leg lower before finding the ultimate bottom.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.