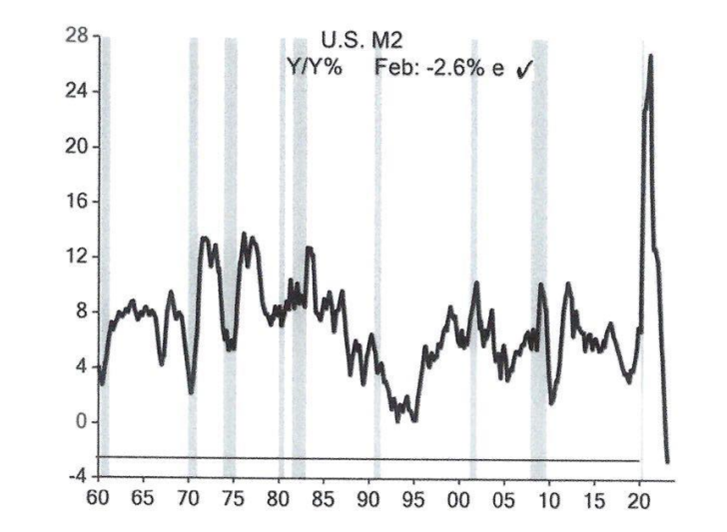

Supply and demand drives inflation, including the supply and demand of money itself. Why did inflation spike in early 2022? Because we had record money supply growth in BOTH 2020 and 2021 combined with a Fed unwilling/late to act with regards to rate hikes. The M2 chart below captures the recent history of money supply growth. The US economy had never experienced back-to-back years of >20% money supply growth (including during extraordinary periods such as WWII). Money supply spikes, inflation spikes.

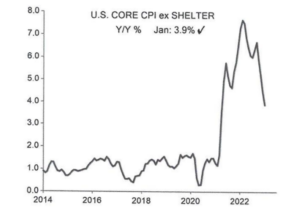

But just as quickly as money supply growth spiked, it is now collapsing. The excess money supply growth induced by COVID stimulus is plummeting. Core inflation ex shelter costs (the one watched very closely by Fed chair Powell) has started to fall and should continue to fall very, very quickly. This week’s minor market indigestion is the result of higher yields and the fear the Fed will be forced to hike rates further. The problem the Fed has is that inflation data is very backwards looking, and they don’t want to get caught trying to cure a problem (inflation) that has already been solved by higher rates and a complete collapse in the growth of money supply (liquidity). I continue to believe that the Fed has 1, maybe 2, hikes left in them…then they will be done.

Our themes and beliefs remain the same: Growth stocks and tech are allergic to higher rates. Value > growth. And once yields peak out, the USD dollar will follow and fall. That will resume strong performance in non-US equities relative to US equities (and yes, that includes China and EM).

Source: EISI as of February 21, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.