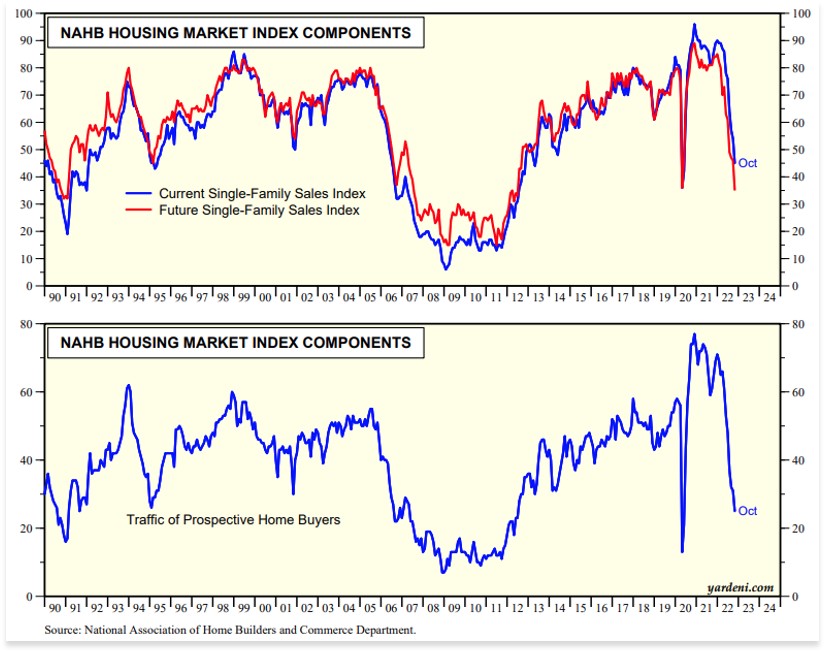

While the Fed continues to maintain its focus squarely on slowing inflation and employment, in the meantime it’s the housing market bearing the brunt of their demand destruction campaign. This week brought the latest evidence of a major slowdown unfolding. On Tuesday, the National Association of Home Builders released their monthly sentiment survey which showed another big drop-off in current sales, sales expectations, and prospective buyers’ traffic. Outside of the pandemic, these are the lowest levels since 2012. And with all three of these below 50 and falling, it’s a clear sign that homebuilders are bracing for trouble ahead. Keep an eye on home prices, which are likely the next to soften.

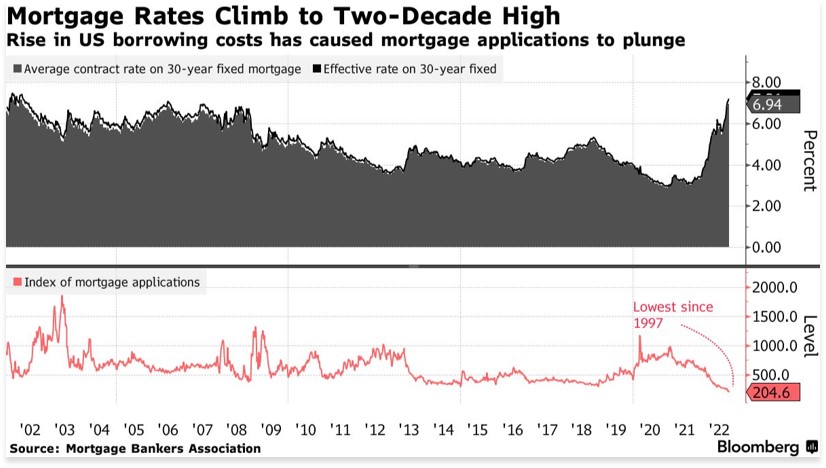

Yesterday, we learned that the national average 30-year mortgage rate rose to a new high of 6.94% – the highest in 20 years. Mortgage rates that have more than doubled in the past year combined with sky-high prices has caused affordability to crumble, which is now weighing heavily on demand. Indeed, applications for new mortgages have plunged to their lowest level in 25 years. Demand destruction on full display.

The good news this time around is that this doesn’t appear to have the makings of another housing crisis that snowballs into an all-out financial crisis. Housing’s been chronically undersupplied in this cycle, and shoddy lending is a thing of the past with much more stringent underwriting and 20% down payments required. In fact, homeowner’s equity hit a record high earlier this year, and most homeowners took advantage of the historically low rates of the past few years to refinance. Mortgage defaults can still occur in some cases but are likely to be far more isolated & sporadic, while banks have much higher capital buffers these days making it easier to absorb them without putting the entire system at risk.

Housing is typically one of the first parts of the economy to succumb when a cycle turns, and this time’s been no exception. That means it’s also a good place to watch closely for any signs of bottoming in the months ahead.

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.