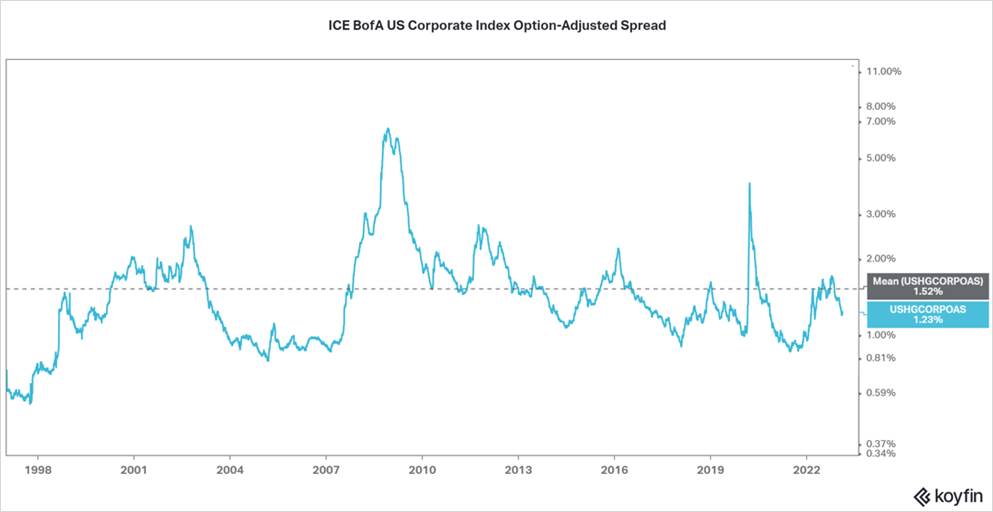

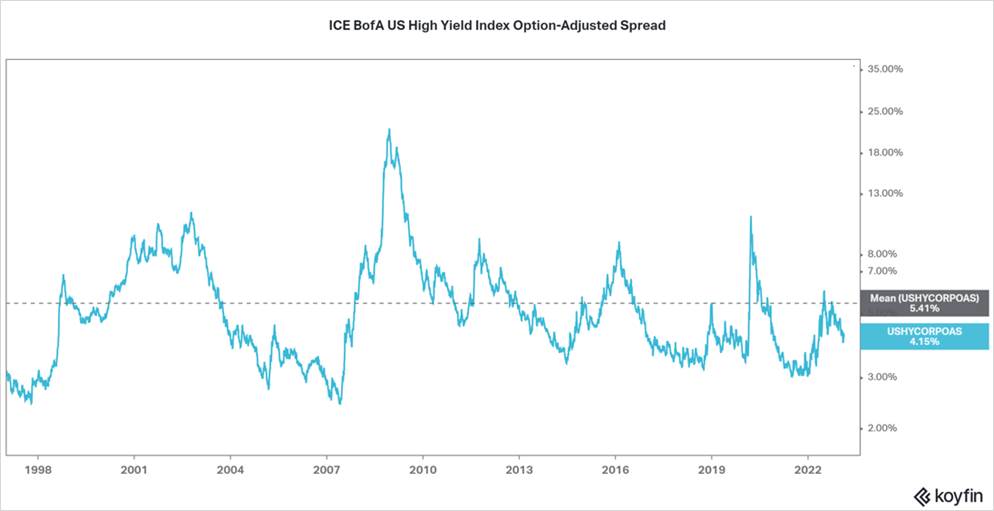

With fears of oncoming recession still swirling, the corporate bond market continues to mostly mimic a big shoulder-shrug about that very prospect. As we’ve noted, the difference in yield between corporate bonds and comparable risk-free Treasuries (i.e., the credit spread) is one of the go-to places to look for signs of concern, stress, fear, etc. Higher spreads = more fear as the bond market prices in more of a premium for riskier debt, and vice versa. While some of that did start to materialize earlier last year, it’s largely evaporated over the past several months as yields and spreads have come down from their summer peaks.

Currently, the spread to Treasuries for both high-quality (i.e., investment grade, 1st chart) and low-quality (i.e., high yield/junk, 2nd chart) corporates has fallen back below their longer-term averages shown by the horizontal dashed lines even as layoff announcements have picked up, corporate profit margins have come under pressure, and additional Fed rate hikes remain in the pipeline. In other words, even in the face of some mounting headwinds the corporate bond market is acting as if things aren’t all that bad for the economy just yet.

From an investment standpoint, spreads below the averages also reflect a lack of good long-term value and thus we continue to largely avoid the high yield debt market. If the economy does eventually flirt with recession, then spreads will widen and that will present more of an opportunity to begin to allocate to riskier debt. But we’re not there yet.

Things can change quickly and if the Fed does push too far then corporate spreads will eventually react to that. For the time being, they reflect an economy that is holding up better than some of the dire expectations out there. Keep watching this market.

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.