Yesterday’s CPI inflation data notes an economy that still has elevated inflation, but the trajectory of inflation is cooling and cooling very quickly.

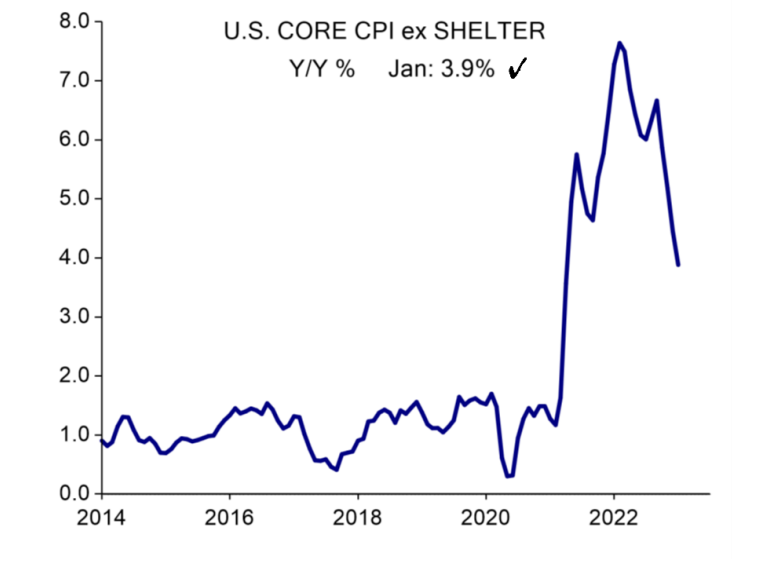

Core CPI excluding shelter costs was up just +.17% MoM. On a year-over-year basis, Core CPI ex shelter was up +3.9%. A year ago, CPI ex shelter cost inflation data was well over >7%. The combined efforts of the Fed to both hike interest rates and shrink their balance sheet has made a meaningful impact on inflation and the trend of inflation. Eventually the drug works and tougher financial conditions are at work. Rental shelter costs are falling in every survey we look at. The upcoming decline in shelter costs should lead the headline CPI number to come down quickly in the very near term. We need shelter costs to fall and the labor market to weaken. Those are coming attractions.

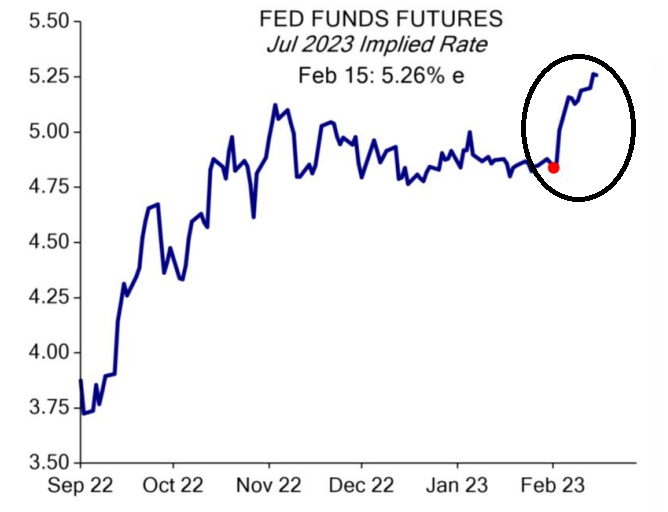

Big picture is that the market reaction to higher-than-expected headline CPI on Tuesday was to push yields higher, basically pricing in another Fed hike in May. The UST yield curve remains very much inverted and recession looms. The risk is that the Fed hikes another 25bps in May, likely a final hike that will prove too much to avoid a so-called “soft landing” for the economy. Sometimes the way to win is to stay away from segments or asset classes not in the path of progress. Growth stocks are allergic to higher yields (we prefer value > growth) and a hard landing for the economy will bring about a rush of high yield bond defaults. We’re staying away from HY credit for now.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.