We talk often/always/incessantly about “cycles”. Market cycles are driven by the broad availability and cost of money. Market cycles are driven by economic growth and contraction. They are driven by innovation, investment, corporate earnings, employment, and credit availability. Market cycles are like the ocean tide: they go both in and out, sometimes with force.

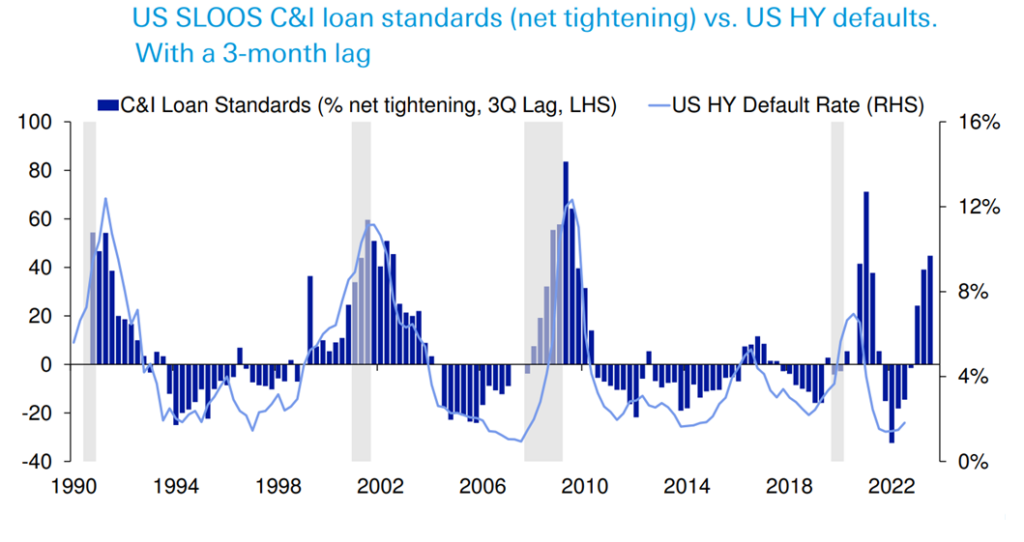

If corporate earnings are what drives the equity market over time, it is lending standards that drive the direction and scale of credit defaults. Credit defaults = permanent loss, not temporary price impairment. When lending standards start getting tight, bond defaults start to appear in the high yield bond market about 6-12 months later. Financial conditions tightened dramatically during 2022 and lending standards have gotten a lot tougher. Tighter lending standards in 2022 will translate into a rising level of HY bond defaults in 2023. It’s not a question of “if” they go higher; it’s only a matter of “when”. The equity market had its volatility and recession in 2022. The high yield credit market will have its defaults during the recession of 2023.

In our mind high yield bonds and low-quality credit remain an area to avoid. We will continue to do so until defaults pick up and HY prices fall A LOT. That is likely a 2H23 event.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.