This morning’s long-awaited CPI inflation data came in softer than expected and the market loves it. SP500 futures were positive +6pts heading into the 8:30am EST CPI inflation announcement – quickly traded at +94pts post inflation data release. In a market starved for good news, softer inflation is clearly being welcomed.

Quick highlights – we’ll have a deeper dive out later:

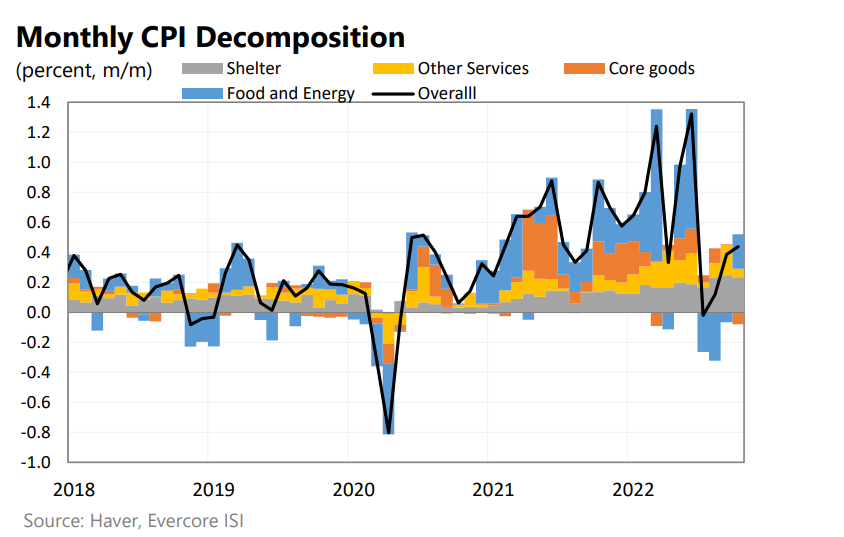

- Headline CPI inflation came in at +.4% MoM, better than the +.6% expectation.

- Both core goods and core services experienced MoM deceleration.

- Core goods came in at +.4% which was softer than expected. Used autos prices notably soft, down -2.4% for the month. Used car prices have been falling for 4 months in a row now.

- Core services ex shelter costs was the big surprise: just +.23%, down from +8% MoM.

It looks like inflation is “cooling”. My quick takeaway is that if the Fed was looking for a path to slow the pace of future rate hikes, this data certainly helps that cause. Still a ton of economic releases in the next 30 days but this is a big step in the right direction. If coming economic releases confirm a “cooling” trend with regards to inflation, the market is saying the Fed will do a 50bp hike in December and likely slow to 25 bp soon thereafter. Markets are only forward looking and lack a rearview mirror (unlike us humans). If the future looks like once very elevated inflation is coming down and coming down a lot, a beaten and battered equity market with low investor sentiment readings is ripe for a rally.

Truthfully, we need more “bad news” cuz’ “bad news” now equals “good news”. #badnewsisgoodnews

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.