I want to talk about market cycles and just how different and unusual the current one is. My apologies for the length of this email, but sometimes there’s no appropriate shortcut available…here goes.

Market cycles have always followed a relatively consistent pattern. Times get good and the economy does well. Job growth is robust and people get raises. Those raises get spent and the economy gets hotter. The Fed starts to hit the brakes to slow the economy down but that generally takes a few years to develop. Along the way investor enthusiasm and sentiment grow and the stock market grinds higher. But the Fed ultimately raises interest rates too much and sends the economy into recession. Investor sentiment falls as stock market prices fall. An official recession is declared, the unemployment rate heads higher, and the Fed starts to cut rates within a matter of months to save a weakened labor market. That’s how market cycles have historically been conceived, live, suffer, die, and are reborn once again.

This current market cycle has been very, very different. We got hit by a once-in-a-century level global pandemic and shut down the global economy to prevent further serious illness. Unprecedented money supply growth led to a spike in inflation. The Fed complicated the situation by being far too slow to act to persistent rising prices. To be precise, the Fed actually made things worse by continuing their practice of bond buying and money printing (quantitative easing) well into March 2022. The market’s reaction to a Fed with their head seemingly stuck in the sand was to run away from risk assets and take investor sentiment levels to historic lows. Unlike past cycles, all that happened WAY BEFORE the yield curve inverted. We’ll likely have a recession in early 2023, and history says markets don’t bottom until we are well into a recession and investor sentiment falls then too (again, sentiment follows price). But that has already happened. Up is now down and down is now up. The natural order of market cycles is not being followed. We had never seen anything like a global pandemic before and this cycle is not like any market cycle before. Let’s review the details.

Unprecedented explosion in money supply growth led to inflation spike: The chart below captures YoY growth in M2 money supply growth. For +40 years leading up to the onset of COVID in March/April 2020, annualized money supply growth ran about +/-5% per annum. That level of growth was generally tied to the level of growth in the US economy, the need/desire/demand for USD from outside the US, and a steady but gentle level of homegrown inflation. The stimulus response to COVID – while swift and powerful and big and warranted – carried with it an unprecedented growth in money supply. Instead of growing at +5%, money supply grew at +25% for back-to-back years. Why do we have inflation? It’s because we have too many dollars chasing the same/fewer level of goods. CPI inflation spiked on cue (second chart below) as the Fed slept and kept policy uber accommodative.

Annualized growth in M2 Money Supply dating back to 1976

Annualized growth in CPI Inflation dating back to 1976

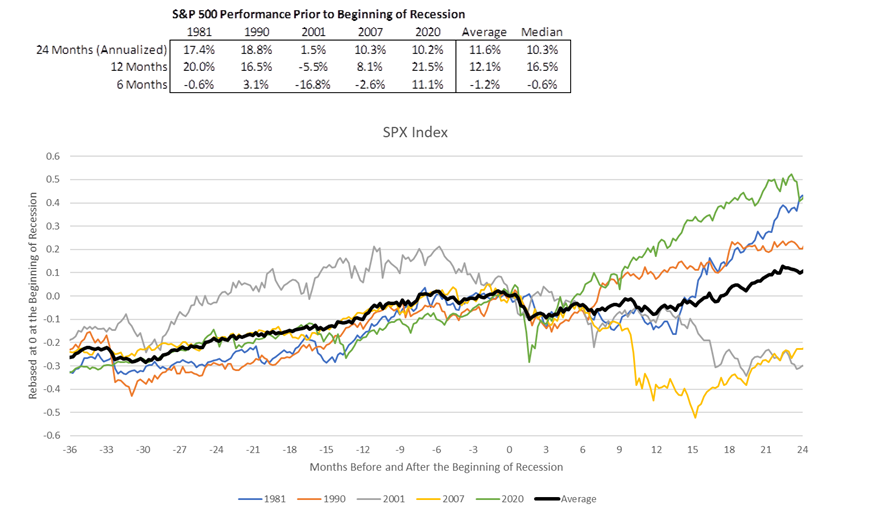

#1. Why is this cycle different than the last five recessions we’ve had? Risk assets have already been punished PRIOR to the onset of a recession. Generally, the stock market goes up 24 months prior to a recession and only starts running into mild drawdowns within 6 months of a recession. The chart and data below support this. This time is not like that at all. This time around, the market went down -20% at least 12 months prior to when an official recession will likely be registered (assuming an official recession is declared sometime in 1H2023). In 2022 the most pain has been inflicted on growth stocks because they are hyper allergic to higher rates. Speculative investments like fintech SPACs and cryptocurrencies – the darlings of 2021 – have also been punished accordingly. (zero on the bottom axis is the official start to recession)

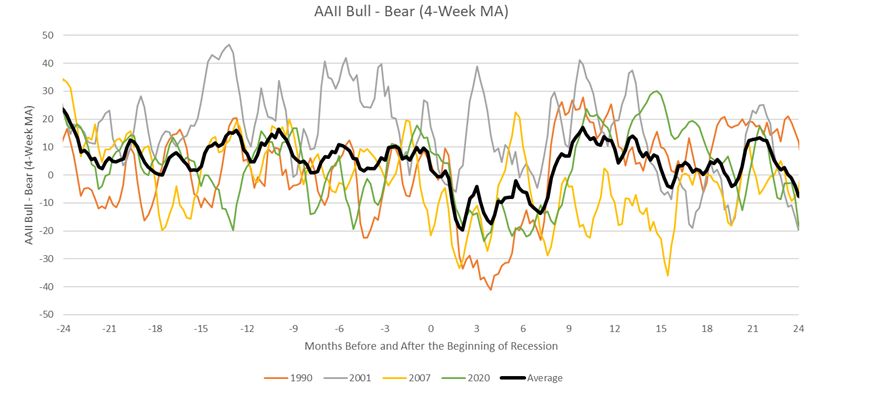

#2. Why is this cycle different than the last five recessions we’ve had? Investor sentiment has already been crushed PRIOR to the onset of a recession. The AAII Bull Bear ratio is as good as any measure when evaluating investor sentiment. A big positive reading notes lots of bullishness (generally not great for forward market returns) while big negative readings denote extreme bearishness (generally signaling very good forward returns). History says that investor sentiment doesn’t go down until AFTER a recession as officially started. Not in 2022. In 2022, investor sentiment has been in decline the entire year. Sentiment follows prices, not vice versa. Current sentiment readings look like we got hit by a recession last spring, not next spring. The timing is off – much like the market going down in advance of a recession and not bottoming until AFTER a recession is here. As said already: Up is now down, down is now up. (zero on the bottom axis is the official start to recession)

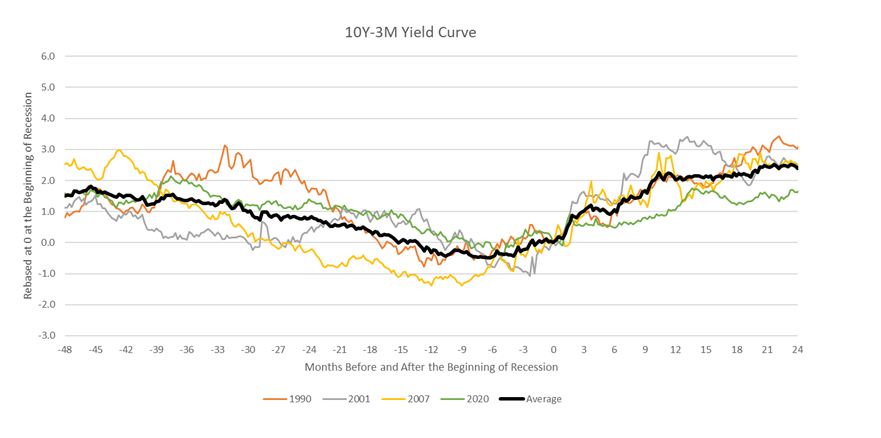

#3. Why is this cycle different than the last four recessions we’ve had? The yield curve generally inverts 12-24 months prior to a recession. Not this time. A yield curve inversion only recently occurred although we are at the doorstep of a recession. The Fed likes to quote the shape of the yield by looking at 10Y UST minus 3mo bills, so we’ll go with that. Because the Fed got so far behind with regards to inflation and a rate path, only recently did the 10Y UST and 3mo UST yield invert. As the chart below notes, the curve inverts 12-24 months in advance and actually starts to steepen once we hit a recession. This tried-and-true signal about market cycles never flashed danger, despite the market going down (earlier than it has historically) and sentiment following price lower (which it did in early 2022). (zero on the bottom axis is the official start to recession)

Conclusion: The point of all of this is that there is simply no playbook for global pandemics and certainly no playbook for exiting a global pandemic. Stimulus giveth and stimulus taketh away. Historical relationships between markets and sentiment and credit availability are not being consistent this time around. They weren’t in the good market of 2020 and 2021 and haven’t been in the bad market of 2022. Markets generally go up leading up to a recession and bottom in the middle of a recession. In my opinion, that is unlikely this time given that the market move lower has already occurred. Investor sentiment usually is high just prior to a recession and deteriorates in the middle of a recession. We are already at historical low investor sentiment readings. And the yield curve is the yield curve: an excellent predictive tool of credit conditions but this time the yield curve inversion happened very, very late because the Fed got very, very, very far behind the curve with regards to both rates and inflationary pressures.

Own quality, be diversified, avoid popular/expensive ideas, exercise often, and always know what you own. There are only two prices that matter: the one you pay for an asset and the one you sell an asset at. Along the way, the ups and the downs and the volatility and gyrations are just merely observations of somebody else’s price experience. I believe we are likely to have a recession in the coming months, I believe the Fed will likely pause/pivot on rates at the first sign of higher unemployment, and with a market already down a lot and sentiment already very weak, recessionary “bad news” will be treated as “good news” by the stock and credit markets.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.