Retail sales remain strong, unemployment claims remain low, and broadly speaking economic growth as measured by consumption and GDP is solid. That’s the good news.

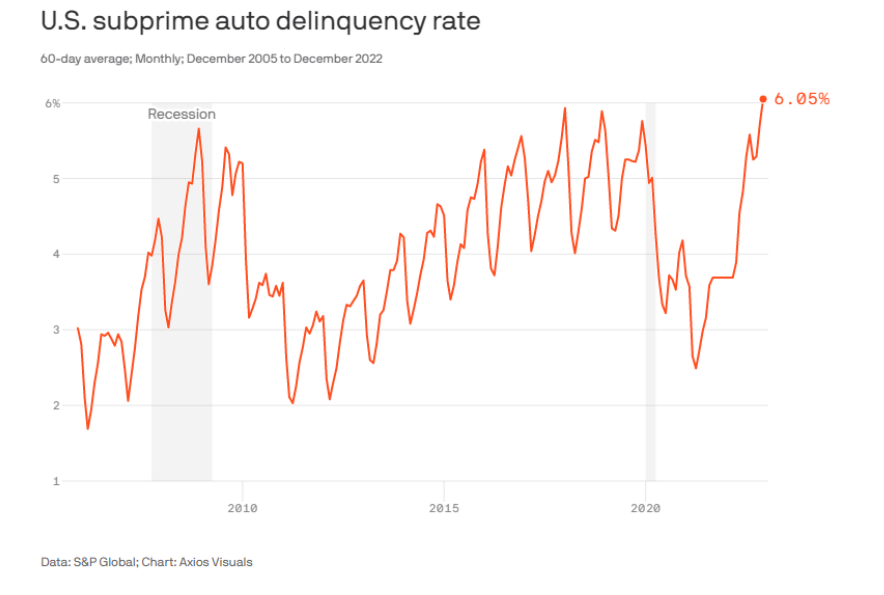

The bad news is that some cracks are starting to emerge in consumer lending. Subprime auto loans is lending to those with the worst credit scores so they can drive something off the lot. Delinquencies are on the rise. This isn’t the housing crisis of 2007/2008. Mortgage delinquencies and auto delinquencies are two very different things. The repo man comes and takes care of the latter. But the combination of higher interest rates, tighter financial conditions, and a high level of inflation has low-quality auto borrowers paying late. It’s symptomatic of lending standards going up a lot, money getting expensive, and borrowers determining which bill gets paid last (or late) when inflation spikes.

We are staying away/avoiding/being distant from low-quality lending on many fronts, ranging from high yield bonds to sub-prime mortgages, to low-quality, risky consumer credit. Critical to distinguish between temporary and permanent loss. Low-quality credit is at risk of permanent impairment.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.