Recession, earnings, the Fed, ongoing war, housing concerns, debt ceiling, over-valuation…. The gloom can crush you. Don’t listen to it. Look at the data:

- S&P 500 price is above the 50-day moving average and above the 200-day moving average

- S&P 500 50-day moving average above the 200-day moving average (golden cross) which has historically led to higher future returns

- Monthly momentum indicators turning higher (Coppock, MACD)

- Every day this year new 52-week highs > new 52-week lows

- 75% of stocks above its respective 200-day moving average

- 10 out of 11 S&P 500 sectors above its respective 200-day moving average (only outlier is very defensive Utilities sector)

- Global breadth surging

- Cyclicals > Defensives

- Small Cap Stocks > Large Cap Stocks

- High yield and investment grade spreads tighter

- Cash levels still at all-time highs

I could go on and on pointing out bullish data, which completely flies in the face of the narrative.

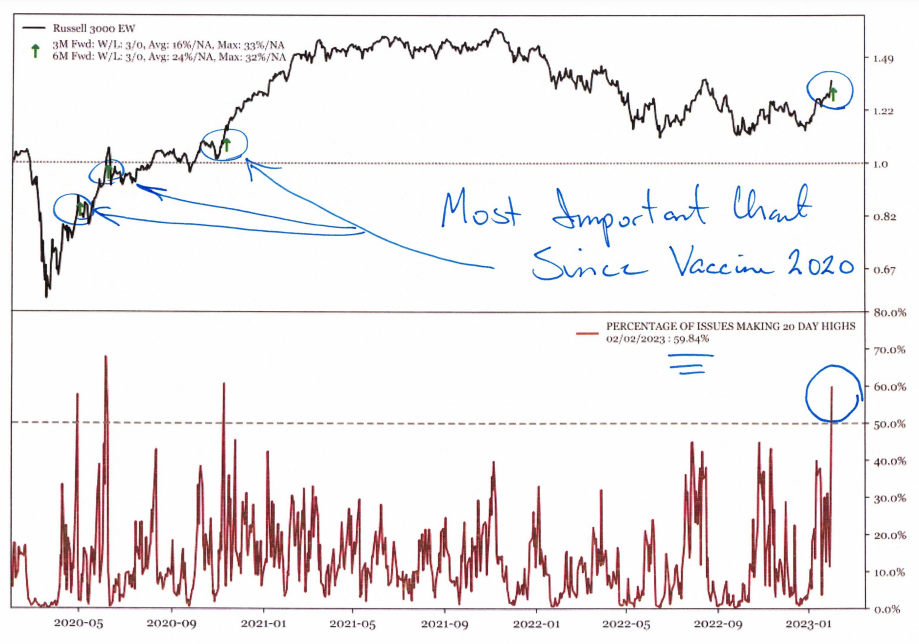

And now we are seeing ‘escape velocity’ according to Jeff DeGraaf at Renaissance Macro. This is occurring during a week when the Fed raised interest rates and hinted at a few more, the mega-cap earnings Thursday night were lackluster to say the least, and there was a monster jobs report that would have sent the market into a tailspin 4 months ago. The market is shrugging the news off, climbing that wall of worry. The probability of a new bull market is high.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.