The rarest thing of all: today we had both a total lunar eclipse (technically it was a “blood moon”) and yours truly discussing election cycles and market returns. Rare or rarest? You pick.

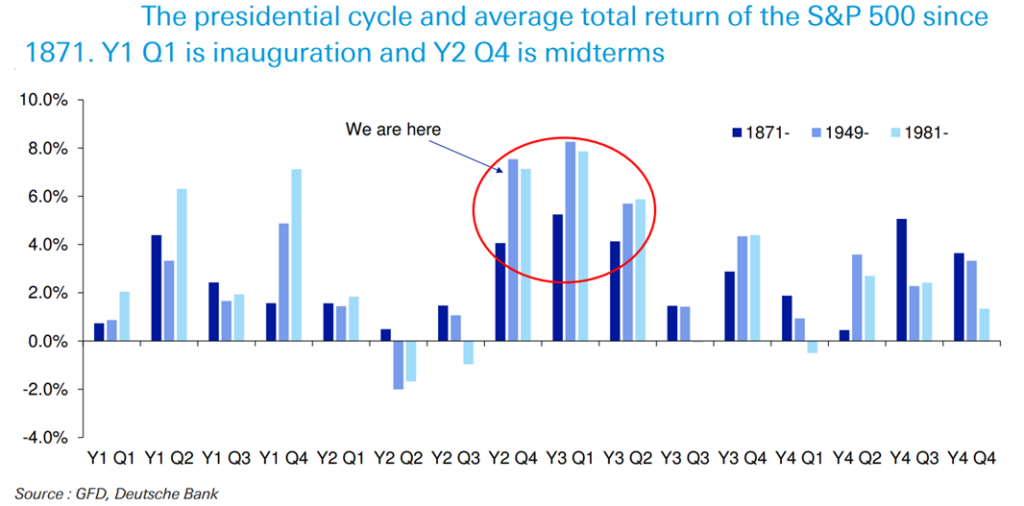

There have 19 mid term elections in the post WWII era, with all 19 noting the S&P 500 higher 12 months later. If you go back 150 years (yep, years) and look at the best quarters of any presidential cycle (starting with inauguration day and ending with the following presidential election), the best three quarters of stock market returns look like the three quarters that immediately follow the mid-term election. Things can always change, but 19 for 19 is an impressive record. It’s also what you talk about when you want a break from the “all Fed all the time” news flow we’ve all experienced.

Great day to celebrate democracy. Vote early and, if you must, often. Enjoy.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.