Last week’s Consumer Price Index inflation data noted elevated levels of inflation but also some signs that inflation may be near to peaking. Financial conditions (stock market selloff, higher mortgage rates, higher inflation rates) are likely causing demand to soften.

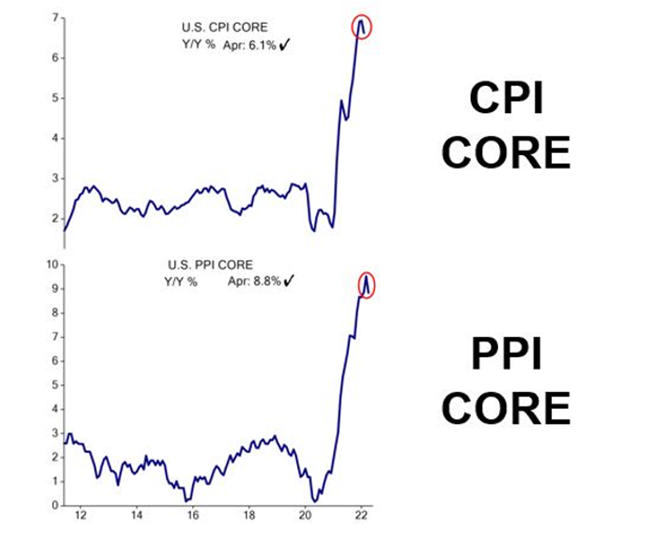

The bad news is that both Core CPI and PPI inflation data still looks elevated. Core CPI did fall to 6.1% YoY from 6.4% YoY. Core PPI inflation metric fell to 8.8% YoY from 9.5% YoY. Falling is better than rising but these levels are still elevated and a headwind for both the market and the Fed. Energy prices also still elevated and not declining. Natural gas, gasoline prices at the pump, and WTI oil per barrel all elevated and firm.

The good news is that financial conditions have dramatically tightened WITHOUT the Fed doing much/anything. Headline CPI was +.33% MoM – the smallest increase MoM in 8 months. Copper prices, corn, and wheat all elevated but looking like they want to start to decline. Unemployment claims have quietly ticked up over the past month and the growth in money supply is coming down quickly.

All this to me looks like broad inflation pressures likely in the process of peaking. I like the 10Y UST today a lot more today at 2.91% than last Monday at 3.21%. Economic demand about to go down and with it inflation.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.