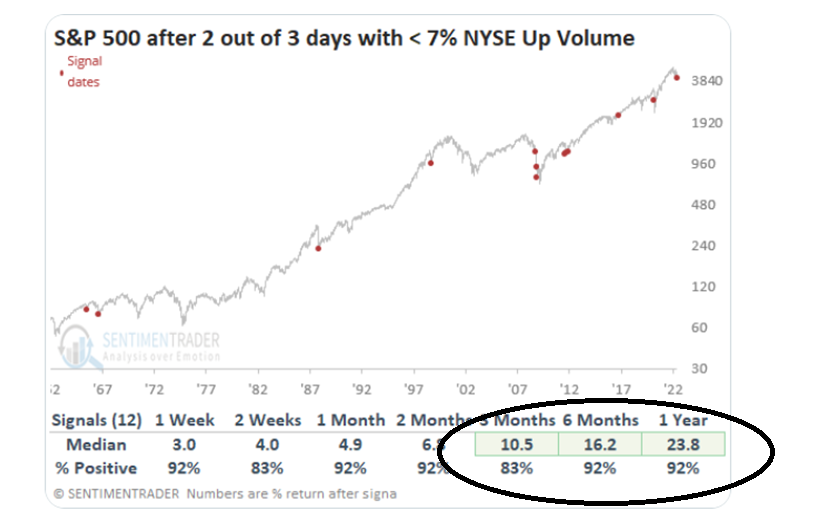

There have only been 12x in the past 60 years in which greater than 93% of the trading volume of the SP500 was negative for two out of three days. Only 12x. Yesterday was #12. Trading volumes get quoted in terms of “breadth”. We are currently experiencing extreme negative “breadth”.

Out of the other 11 observations, 10 experienced significantly positive forward returns looking out 3 mos, 6 mos, 12 mos forward. The single observation in which that didn’t occur was in February 2009. During that observation, the market went lower into early March 2009 before recovering sharply. While that observation didn’t have positive 3mos returns, it did looking out both 6 mos and 12 mos.

We are extremely oversold with respect to market conditions and economic demand forecasts looking out 3-6 months are coming down quickly. The 10Y UST needs to peak in terms of yield for stocks to peak in terms of drawdowns. The 10Y UST was at 3.21% at 3am Monday morning. It’s at 2.97% right now. The peak in yield is the likely bottom for stocks. #followtheyield

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.