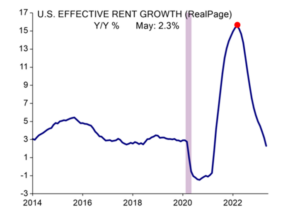

The CPI Index captures trends in consumer prices, the stuff that you and I all consume each day in various ways. The CPI Index is roughly comprised of 40% housing costs, 20% for food costs, and 40% a catch-all of other expenses. One big driver of CPI inflation in 2022 was the sharp rise in rental prices paid – but as the chart below notes that now appears to be over.

RealPage offers software solutions to the multi-family rental industry. They have great data on what is going on under the hood in rental apartments and the chart below says that the best days for big rent increases is now behind us. In early 2022, annualized rent growth spiked +15% YoY but that now has come down to earth. Most recent data out of RealPages notes just +2.3% YoY increase in rent – back to the average for the 10y prior to the post COVID stimulus spike in rental prices.

The implications for markets/portfolios are that headline CPI readings are likely headed materially lower in the coming months. The Fed knows this data and sees this data too. Odds for a June 2023 Fed rate hike now down to 22% today from 60% two weeks ago. I think the Fed is now indefinitely in “pause mode” with regards to rates. Fed chair Powell can take the summer off.

Source: EISI as of June 5, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.