Eighteen months ago, the financial markets began their transition from a zero-interest world to a world of higher nominal and real yields. The history books will have the final say, but those pages will likely include a chapter or two on how the global central banks printed nearly $8 trillion too much currency via monetary and fiscal stimulus in 2020/2021. Too much money chasing the same/fewer goods equals higher prices and higher yields. The past eighteen months have had plenty of equity market volatility and a tremendous jump in bond market vol, especially in high quality, very long duration sovereign European debt.

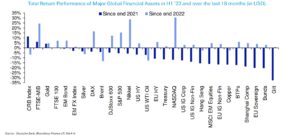

The light blue bars in the chart below capture the global asset class performance over the past 18 months. Winning asset classes are few and far between. As one would expect, traditional inflation hedges like commodities and gold did reasonably well. My colleague Sauro also takes great pride in how well Italian equities have done. The big losers over the past 18 months all look the same: very long duration European sovereign debt that left a negative interest rate world and took a big hit in both nominal and real return. UK Gilts down -33% in nominal terms and closer to -40% in real terms (after inflation). German bunds not far behind at -17% nominal and -23% real. Ouch! We are not going back to a zero-rate world anytime soon so the recovery time for those particular asset classes could be a decade or more.

Just six weeks ago investor sentiment was awful, the US debt ceiling saga loomed, and the bond market started pricing in the possibility of a +50bp rate hike. We’re past all that and higher prices for stocks have brought sentiment back to the middle ground. Sentiment follows price – it’s rallying now as prices rally for stocks. The SP500 stands close to a 14 month high today. The thing we are most focused on now is 2Q corporate earnings and whether the Fed sees inflation cratering like we do. Back to basics: its earnings that drive stock prices from here.

Finally, as we approach July 4th, let’s remember that it was only 247 years ago a group of farmers and statesmen announced to the world their declaration of independence, pronouncing “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty, and the pursuit of Happiness.” Our democracy remains an experiment, but no has ever said it better than Warren Buffet with regards to our country and its opportunities: Don’t ever bet against the USA.

Source: Deutsche Bank, Bloomberg Finance LP, Mark-It as of June 29, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.