Number #1 question being asked now sounds like this: “Why should I invest now?” The Fed is raising rates, recession risks have surged, economic demand is being destroyed, and volatility is both substantial and persistent. All reasonable reasons why not too invest – there’s plenty of cash on the sidelines yielding little and losing to inflation. But markets are forward looking beasts and know all of this already. Markets, unlike us human beings, don’t have a rear view mirror.

The answer why one SHOULD be invested is lengthy and complex. Here’s a few thoughts (and A LOT of data) about why to be invested. In short, market technicals are A LOT better, investor sentiment is STILL very weak, and months like July 2022 just don’t happen often (and you just got to be there when they do). Let’s go…….

1. MARKET TECHNICALS HAVE DRAMATICALLY IMPROVED OVER THE PAST SIX WEEKS.

The recent market bottom was June 16 – equity markets technicals have dramatically improved since.

- Volatility is falling – the VIX volatility contract stood at a level of 35 on June 16th. Today it is 22. VIX down = lower implied volatility.

- On June 16th only 12% of the S&P500 traded above their 200-day moving average. Today 36% of the S&P500 trades above its 200-day moving average. Huge technical improvement.

- On June 16th only 1% of the S&P500 traded above their 20-day moving average. Today 80% of the S&P500 is trading above its 20-day moving average. Huge technical improvement.

- Market breadth is better for sure – now just need momentum to develop.

2. INVESTOR SENTIMENT IS STILL VERY, VERY NEGATIVE.

Markets need to climb a wall of worry. They feed on worry. Right now that Wall of Worry is standing tall.

- Put/call ratio still elevated – lots of investors buying insurance AFTER the market has already gone down.

- Bull/bear ratio is depressed – 2022 has had plenty of volatility and the bears are firmly in command of sentiment. Not a bull to be found.

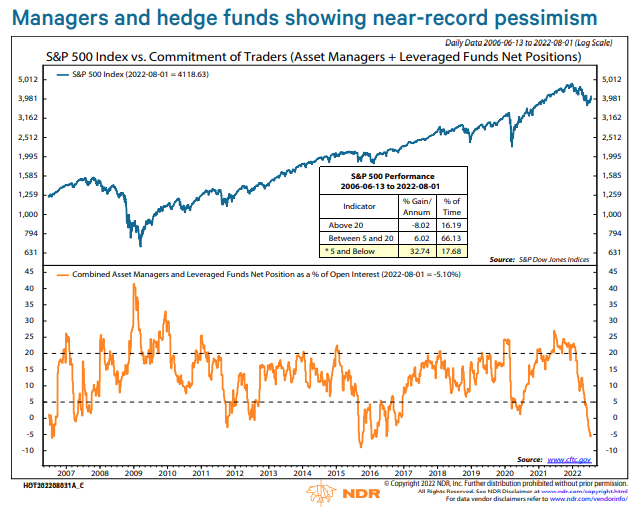

- Net market positioning (see orange line on chart below) is depressed. Net positioning is about market exposure. Less net positioning = less market exposure. The last time net positioning was this weak was in the very final days of the 2008/2009 Great Financial Crisis and right after collapse of oil prices in early 2016. Net positioning is weaker now than when we got hit by COVID. Please see orange line below.

3. And, MONTHS LIKE JULY 2022 HAPPEN RARELY AND YOU HAVE TO BE THERE AND BE INVESTED TO CATCH THEM WHEN THEY HAPPEN.

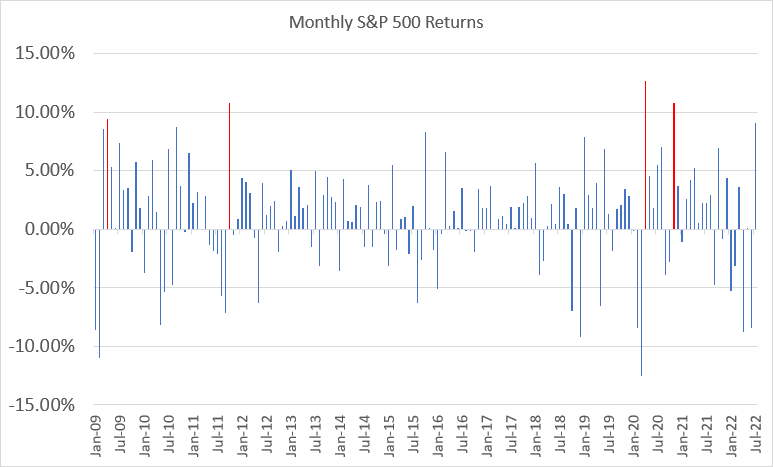

You just can’t be on the sidelines when big return months like July 2022 occur. In the last 13 and a half years there have only been four better return months for US stocks.

- April 2009 – at the very end of the Great Financial Crisis. Market bottomed in early March 2009.

- October 2011 – at the very end of Euro Debt Crisis III and AFTER the US debt got downgraded from AAA to AA.

- April 2020 – after we got hit by COVID.

- November 2020 – after Pfizer and Moderna announced their vaccination success.

- July 2022 – just happened. You have to be in the market to catch +10% monthly gains when they happen because they rarely happen, and none of us know when they will happen.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.