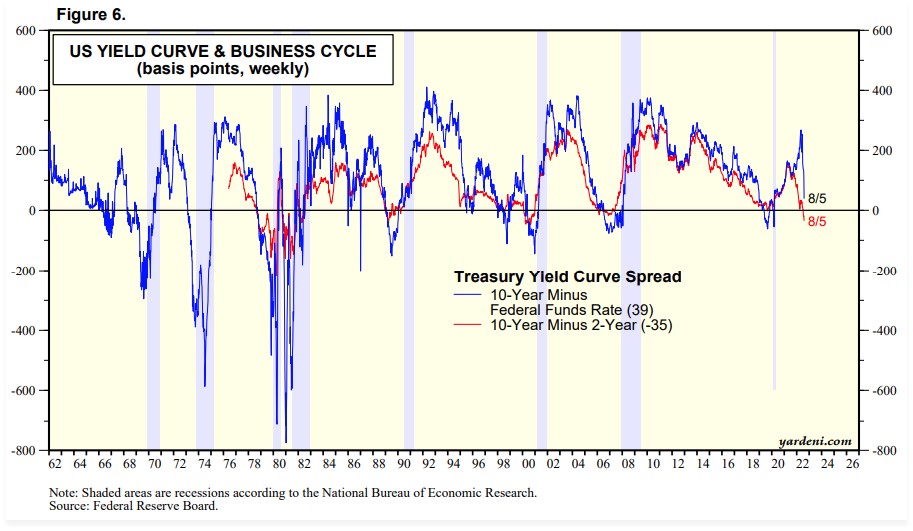

The normally reliable US bond market is sending conflicting signals at the moment, adding to the confusion about whether the economy is currently in a recession, heading into a recession, or will achieve a soft landing and avoid a recession. High quality bonds continue to send warning signals, with the Treasury yield curve inverting further in recent weeks. The difference between 10-year and 2-year treasuries has fallen to -35 basis points (bps) as of last week, the deepest inversion since the turn of the millennium (red line on the first chart below). Another measure of the yield curve which compares 10-year yields to the overnight rate that the Fed directly controls has plunged to just 39 bps, a sharp reversal lower thanks to the Fed super-sizing the last two rate hikes (blue line). While it remains positive for now, if the Fed hikes by another 50-75 bps in September than it most certainly will invert too and recession fears will only grow louder.

While that seems ominous, it is not being confirmed by riskier parts of the bond market which have seen notable improvement recently. Over the past month, high yield corporate bond spreads have narrowed by about 150 bps indicating less stress and less risk of imminent default by the lowest-rated corporate borrowers. If the bond market was truly worried about an oncoming recession, then these spreads would be soaring higher just like they were during the worst of the pandemic. Instead, they topped out in early July just slightly above the level reached in late 2018/early 2019, which was the last time there were concerns about a Fed policy mistake from hiking rates too much. Back then, once the Fed changed tack markets recovered swiftly throughout 2019. While we don’t know if there will be a repeat of that, as long as the riskiest corporations can continue to access the bond market then the odds of a credit crunch and widespread defaults go way down.

So which part of the bond market will prove to be right? Let’s see what the Fed does this fall as more signs of demand destruction appear. A pause in their hiking cycle sometime over the next few months would go long way towards boosting the odds of a more benign outcome – and possibly even the elusive soft landing.

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.