Investment professionals usually talk about the VIX index as a ‘fear gauge’. That is due to the fact that volatility picks up during bear markets, and that is what the VIX really measures; volatility in the S&P 500. Rising volatility is a feature of bear markets until the S&P experiences extreme volatility, which is a signal of major bear market bottoms. Quite interestingly though the opposite is not the same, to some degree. Low volatility is not a reason to expect a major top to form but is a characteristic of bull markets. I believe one of the best uses for low volatility is as a confirmation of a bull market trend.

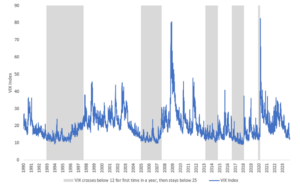

In the chart below you have the VIX in red on top and the S&P 500 in black on the bottom -going back to 1994. Nothing scientific here but in the blue boxes you can see that periods of low volatility tend to coincide with the meat of bull markets, with the one exception being the high volatility bubble in the late 1990s.

Source: Stockcharts.com, as of 12/13/2023

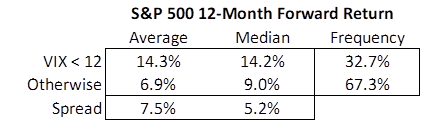

The interesting thing right now is that the VIX just hit 12, which is a very low VIX reading, for the first time in 3 years. Are we just getting confirmation that we are entering the meat of bull market that started in October 2022? Sauro and I decided to put some real numbers behind this and to no surprise they confirmed exactly what we would expect. When the VIX hits 12 for the first time in a year, and for as long as it stays below 25, forward 12-month returns are very strong. This occurs 32% of the time with a forward return of 14.3% compared to 6.9% otherwise.

Source: Congress Wealth Management, Bloomberg, as of 12/13/2023

Low volatility is here. Investors should embrace low volatility, not ‘fear’ it.

Sean Dillon, CMT, CFTe

SVP, Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.