The U.S. Dollar has fallen sharply since the CPI report continuing a downtrend that started at the end of last year. The Dollar has broken below the post COVID uptrend and has moved below key support at $101 (and the nice round number $100).

Source: Stockcharts.com, as of 7/18/23

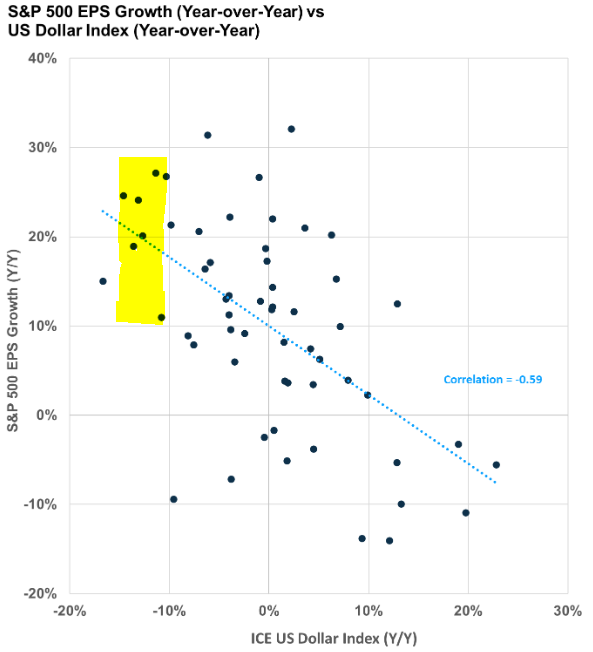

The U.S. Dollar peaked on 9/27/2022 and since then has fallen roughly 12.8%. It’s no surprise that equities bottomed close to that date considering what we know about the relationship between our currency and earnings. The two have a decent negative relationship, so as the dollar falls earnings growth rises. This relationship is plotted in the chart below. If the Dollar is around these levels on 9/27/2023 then the YOY fall will be 12.8%. As highlighted this relationship implies big YOY earnings growth of 10-30%!

Source: Carson Investment Research, Factset, S&P Global, as of 7/12/23

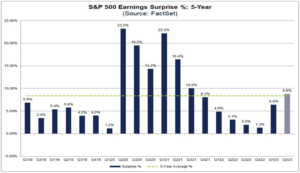

I’d venture to guess this is one of the reasons earnings are surprising analysts this quarter at a higher rate than any quarter back to Q3 2021.

Source: : Factset, as of 7/14/23

Sean Dillon, CMT, CFTe

SVP, Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.