The Federal Reserve controls the front end of the US Treasury (UST) yield curve. The market controls the long end, and the market over the last few months has been worried about supply demand imbalances; rightfully so. My Apologies, you are about to see a lot of charts.

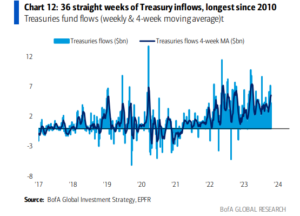

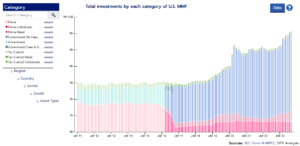

The demand side of the equation has a lot of moving parts. All in all, demand is falling although it is hard to accurately quantify by how much. Some sources of increased demand include European governments as US yields are better than European yields, retail investors and government money market funds as higher yields have attracted inflows into USTs, and institutional investors – specifically pensions and insurance companies.

Source: New Edge Wealth, as of 10/17/2023

Source: New Edge Wealth, as of 10/17/2023

Source: New Edge Wealth, as of 10/17/2023

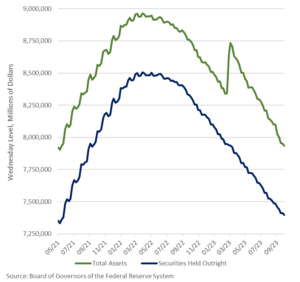

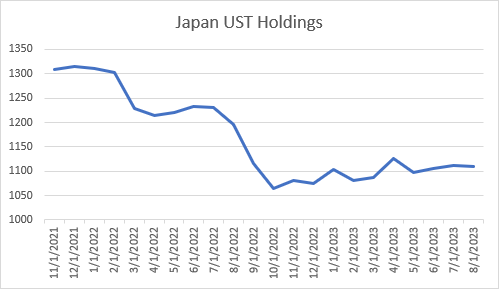

But we can confidently say that demand is falling to some degree due to large holders moving from buyers to sellers of treasuries over the last year or two. The Federal Reserve is engaged in Quantitative Tightening to reduce the size of their balance sheet. China is diversifying assets away from the US, Japan is selling USTs to help defend its weakening currency due to their yield curve control program, and commercial banks are unloading treasuries as deposit balances saw steep declines.

Source: Board of Governors of the Federal Reserve System, as of 9/30/2023

Source: Bloomberg, as of 8/31/2023

Source: St. Louis Federal Reserve, as of 9/30/2023

To bring this home, the quantity of debt that the government must sell is a lot and will remain a lot. 2023 issuance is well above 2013/2018 periods, and next year the issuance will go higher by another 23%! The growing US fiscal deficit and lack of demand from traditional sources have caused yields on long term USTs to rise significantly since April. Of course, this supply demand imbalance will change; but at what interest rate?

Source: Apollo Global Management, as of 9/30/2023

Sean Dillon, CMT, CFTe

SVP, Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.