Last Friday’s strong payroll report noted a robust and healthy labor market – which is the last thing the market wants to hear. The market wants to hear weakness and while there are many signs that some components of inflation are cooling and headed lower, the labor market isn’t one of them yet. That strong labor report followed by yesterday’s strong PPI inflation report and this morning’s strong CPI inflation data has the market reeling. It’s a mortal lock that the Fed will hike rates +75bps in November and certainly more than +25bps in December. A level of inflation that looks like mid-single digits inflation is going to be met with something that looks like mid-single digits Fed funds rates. The 2y UST rate is already well on its way there. I believe that if the Fed hikes 75bps again in December we will have a recession by February/March at the latest. Much of that economic outlook is already priced into today’s market prices but as of now the bears are in control of price. Remain buckled up.

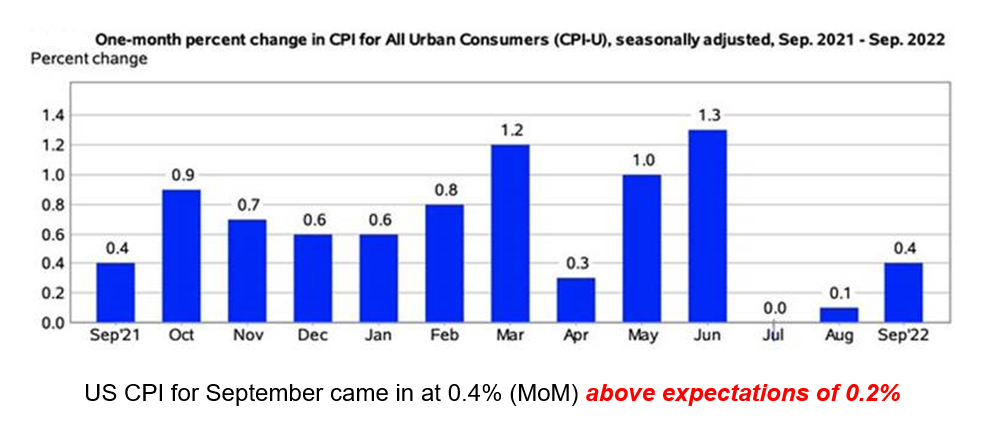

Here’s a quick summary of CPI inflation trends for the past year. The trend is better but not good enough for the Fed to pause on rates. They will need to see monthly CPI down to .2% increases before they hit the brakes on additional rate hikes. Ultimately the Fed will hike too much, and Fed chair Powell will be blamed for a recession. The likelihood for that scenario increases with each passing day.

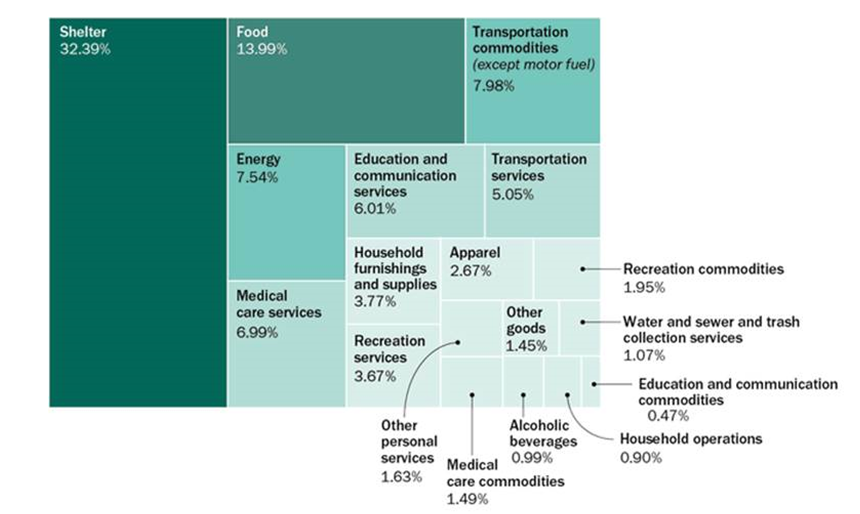

One question I often get now is “what exactly is CPI inflation?” The colorful chart below is a good summary of how that is calculated. Shelter costs and food account for roughly half of CPI inflation data.

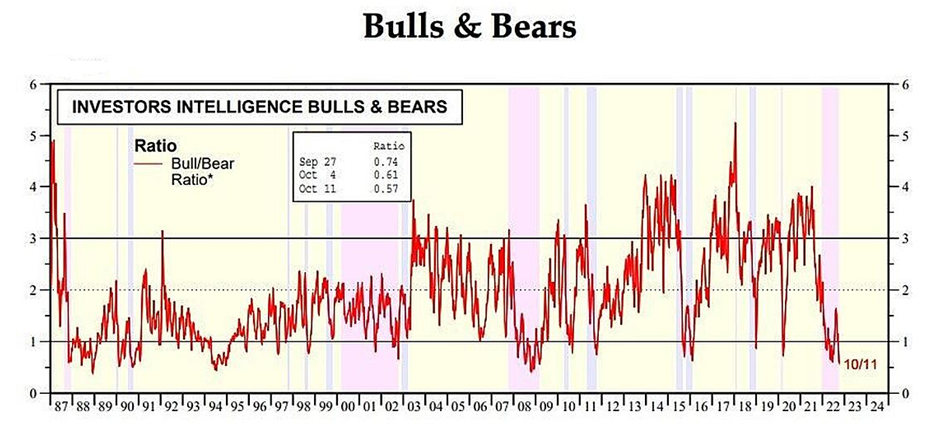

Lastly, Carl sent over a good chart this morning to the team on sentiment as measured by Bull/Bear ratio. This widely quoted sentiment data just registered a reading of .57 – the bears are in complete control. Bull/Bear ratio data down for four weeks in a row now. The last time that happened was March 2009 at the very, very bottom of the great Financial Crisis. If you are feeling bearish, you are not alone. Forward returns from such bearish sentiment readings are excellent. Actor Matt Damon did a foolish bitcoin commercial during last year’s Super Bowl. “Fortune favors the brave”. I think that has very little to do with cryptocurrency and everything to do with why you own/need to own equities during a bear market when sentiment is utterly wiped out. It’s the forward returns from EXTREMELY low sentiment readings that matter.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.