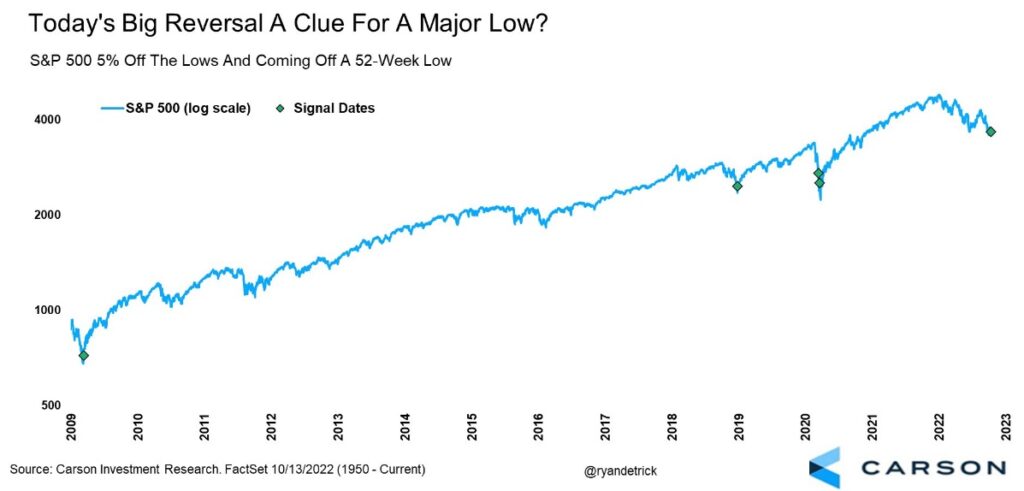

When positioning is historically bearish you get reversal days like we saw yesterday. Intraday, the S&P 500 moved from a low of 3491 to a high of 3685 which is a 5.5% move from low to high. Adding in the fact that 3491 was a new 52 week low, this reversal was an historic event. As the chart below from Ryan Detrick points out, the last three times we saw this type of reversal were in March 2009, December 2018, and March 2020. Could this be another major low?

If it is, we need to see follow through during what is typically the most seasonally bullish time for the market. When you step back and look at the picture wholistically, there is still work to be done.

Breadth is still in bear market mode. The chart below is one look at that using Nasdaq new highs versus new lows. The vast majority of stocks still making new lows compared to those making new highs is not a bull market. Although the improvement (divergence) is noteworthy, the number bottomed at 1700 earlier this year compared to just 887 currently.

Momentum looks very similar, using the weekly RSI. Just as we saw at the end of 2007 and in the middle of 2008, this measure of momentum has not been able to cross above the 50 line. Consistent readings above the 50 line are a characteristic of bull markets, and below it of bear markets. And yet, the improvement in this latest S&P low is notable as the indicator shows slightly better momentum at 38 compared to the June low of 30.

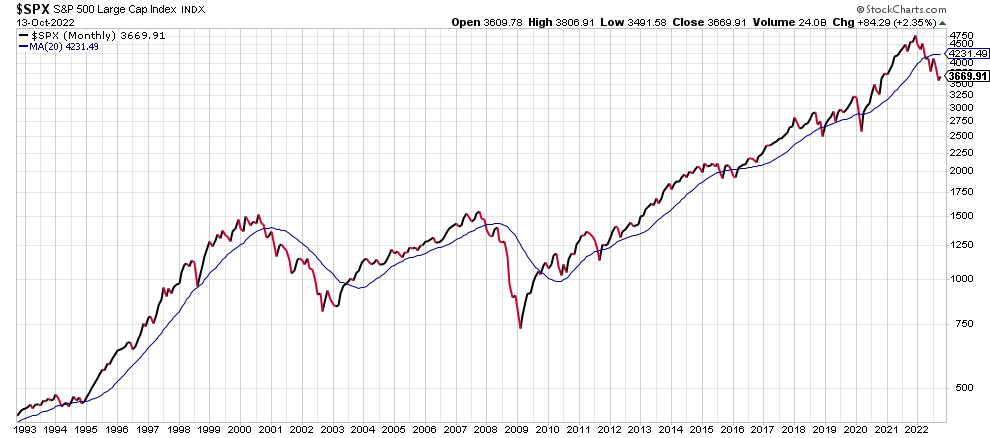

Last but not least the long-term trend has started to turn. The combination of price below the 20-month moving average, and that average moving lower is not a great place historically. Price moving back above the moving average and the moving average sloping higher would be the last ‘confirmation’ of a new bull market but for now it signals caution.

In summary, historic events like yesterday’s reversal could be the start of a new major bull market. Bearishness is pervasive, the fourth quarter of a mid-term election year is usually a fantastic time to put long term capital to work, and we are seeing small improvements in breadth and momentum. However, there needs to be more improvement to tilt the playing field to the bulls. And as the saying goes, nothing good happens under the 20-month moving average.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.