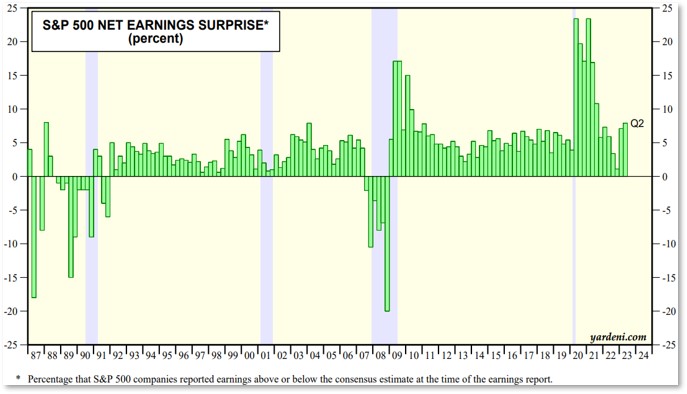

Second quarter earnings season is in full swing, with this being the busiest week that has the largest number of S&P 500 companies due to report results. As usual, investors are laser focused on the latest updates of how corporate America is performing, particularly for mega-cap Tech stocks to try and find out if their dramatic outperformance this year is justified. So far, so good, with encouraging results in recent days from some of the most prominent names like Alphabet & Meta. Even more encouraging is that for the overall S&P 500, companies have exceeded earnings estimates by the widest margin since 2021 so far (as shown in the first chart).

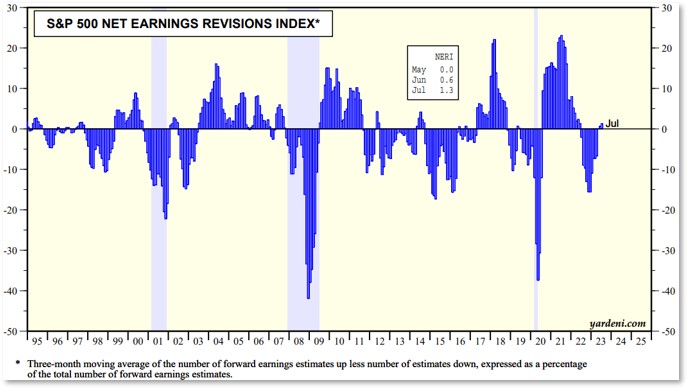

Bigger picture, the important information to be gleaned is the possibility that this quarter marks a positive inflection point for earnings. Earnings growth has slowed for seven consecutive quarters (turning negative for the past two) but is expected to begin improving from -12% in Q2, to 0% in Q3, and +8% by Q4. This is due in part to the economy handily outperforming expectations this year with the widely anticipated recession having still not materialized – underscored by this morning’s impressive Q2 GDP release. Accordingly, Wall Street analysts are beginning to revise their earnings estimates higher as can be seen in the Net Earnings Revisions Index, which just turned positive again for the first time since early 2022. As economic risks continue to diminish in the near term, earnings have room to improve and contribute to what has been an entirely multiple-driven move this year (Price rising with Earnings declining), which would be a welcome development for the sustainability of this rally.

Sources: CME Group as of 5/2/23

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.