We continue to believe that the likelihood of a recession in 2023 is someplace between absolutely certain and virtually guaranteed. Our recession model has been signaling that for a while now as economic demand continues to erode due to tighter financial conditions. Tighter financial conditions (the combination of higher Fed funds rates AND the Fed shrinking their balance sheet) has been aimed at destroying economic demand since last May. It’s unpleasant but it’s working. Container freight rates down -80% since then, trucking rates -35% since then, and natural gas prices -70% since then. Demand down, prices down.

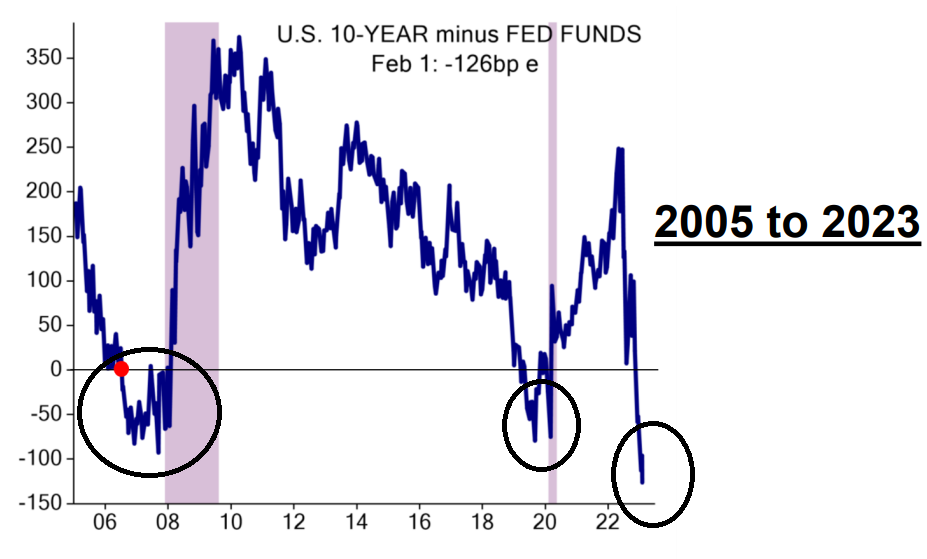

The UST yield curve finally inverted last fall – an excellent predictive tool of coming recessions 12-24 months forward. That’s the chart below. An economic recession is a comin’… and for our regular listeners that should not come as a surprise. Usually during the first twelve months of a yield curve inversion, the equity market continues to chug higher as investor sentiment remains elevated/giddy. However, now 35 months into the bizarre cycle, we now realize that this cycle isn’t like any other cycle. This time the equity market went down PRIOR to inversion and investor sentiment is already someplace between somber/despair. Put another way, we believe the economy gets an economic recession in 2023 but the market already had its recession in 2022.

The implication for portfolios is that risk can and should do well even as we make our way thru this economic slowdown because valuations experienced a major reset already last year and investor sentiment has been obliterated. The biggest area to avoid remains lower quality credit and the high yield bond market in general. That’s where bond defaults will occur when we officially get our 2023 recession. History says the best time to buy that asset class is right during a recession. That timing will likely be mid-2023. Patience all – high yield distressed will likely grow much more attractive mid-2023 but only after a slowdown and only after bond defaults have forced HY bond prices lower.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.