The demise of meme stocks, day trading, and Robinhood (HOOD)

Excess money supply growth led to excess inflation which led to a rise in bond yields. That’s the secondary source of the current market volatility. The primary source is that the Fed has been too slow to react to all of the above and the market is punishing participants until the Fed catches up. That process is well underway. We are far closer to the end than the beginning of that process.

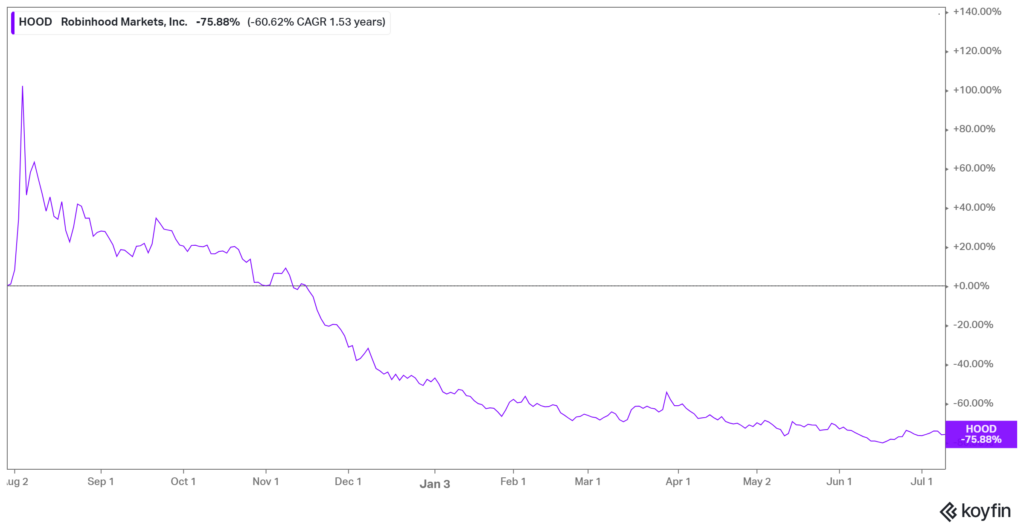

The 2020 COVID shutdown challenged all of us to do different things. As a people, we adopted new technologies, took up new hobbies, and spent A LOT of time with our “loved ones”. Personally, I took up baking and got a Peloton bike. One sort of offsets the other, but I now have some game in the kitchen and make a mean blueberry muffin (the key is to use frozen blueberries and nutmeg, but I digress). Last summer when both rates and volatility were low, the financial press was obsessed with meme stocks like AMC Entertainment and Gamestop. Cathy Woods’ ARKK ETF was another very popular theme meme to follow. Day trading was more popular than a 45-minute Peloton Classic Rock ride and trading platform Robinhood (HOOD) went public. HOOD was a new trading platform which would “set retail investors free”. Day trading was en vogue, the punch bowl was on the table, and the dancing was loud if not proud. That has now all permanently changed. Higher rates have revalued high flying, non-cash flow producing equities down to what they are: low dollar call options on an idea…not multi-billion dollar enterprises. Gamestop this week fired their CFO and announced massive layoffs. HOOD went public in July 2021 and today (just 12 months later) trades -75% lower from its IPO price.

Higher rates have eliminated speculation……and that is a very healthy thing. Volatility will persist until the Fed is caught up. But when that occurs – and it will occur – the market will move hard and fast in the other direction. Sentiment is already at historical lows, valuations have already been reset and when the market gets a whiff that the Fed is caught up on inflation the run towards risk assets will be a stampede. Tough to see now in the midst of all the current volatility but that is the backdrop and is what is setting up.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.