There’s no sugarcoating it – it’s been a very rough week for all of the peak inflationists who’ve been arguing that the worst is behind us. First the Consumer Price Index (CPI) and then the Producer Price Index (PPI) came in well ahead of expectations and soared to new multi-decade highs of 9.1% and 11.3% respectively, underscoring the immense challenge that the Federal Reserve has in trying to put the inflation genie back into the bottle. More and possibly even faster rate hikes are on the way – indeed, the market wasted no time in beginning to price in a full 1% rate hike when the Fed meets again at the end of the month.

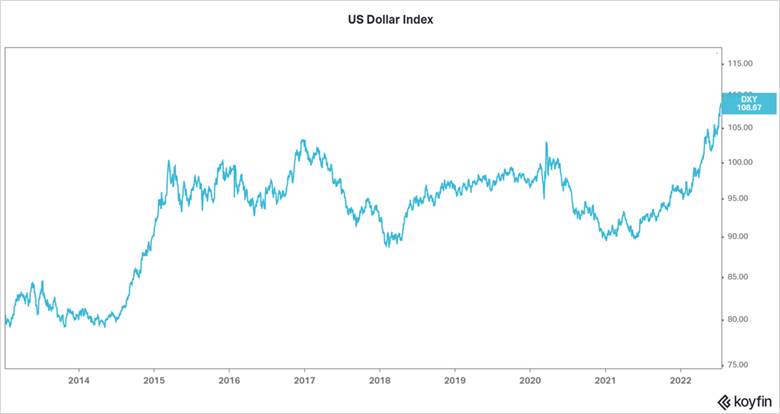

So is the idea of a peak in inflation anytime soon officially dead & buried then? Well, at the risk of joining the inflation Pollyanna’s, we do think there’s growing evidence that a peak may be coming into view. Commodity prices for things like copper, oil, lumber, and wheat have all fallen sharply recently. The trade-weighted dollar has been soaring which translates to lower import prices and is reflective of tighter financial conditions. So-called inflation breakeven rates in the bond market have reversed lower. Leading indicators of the housing market have softened considerably, suggesting that a moderation in prices should soon follow. Private estimates of the value of used cars have clearly topped out and are rolling over. Even the red-hot labor market has shown some tentative signs of cooling.

This doesn’t mean that inflation is going to quickly fall from such high levels back to 2%. It’s going to take time, more demand destruction caused by the Fed, and potentially additional market volatility. But taming inflation is step one in getting through the current difficult environment, and looking beyond the latest headlines there just must be reasons to believe that first step is drawing nearer.

Carl Noble, CFA®

Senior Vice President of Investments

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.