One question I am getting a lot now goes like this: “With the market having had such a strong YTD so far, is it over? Time to sell, time to take risk off the table? When the market has a big first half is the party usually over?” Legit question that warrants a data filled answer.

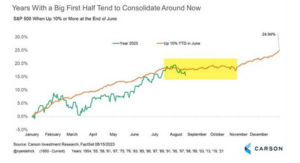

In the last 70 years, there have been 21 observations when the market was up at least +10% through June 30th. The orange line below tracks the history of those observations while the green line tracks 2023 YTD. Two key takeaways:

(1) market strength begets market strength. In the other 21x the market was up at least +10% in the first six months of the year the market finished up an average of +25% for the full year calendar. That’s an average and certainly some years proved outliers (i.e. 1987 = uggh) but a data set is a data set and you include it all. A strong first half usually translates into a strong full year.

(2) a closer look at those other 21x shows the markets also consolidate right around now. History says to expect a trend sideways for a while and then a big finish as all those who get compared against benchmarks chase their lagging performance late in the year.

Don’t be afraid of market strength, embrace it. The other conclusion is that we likely go sideways before we go higher. They don’t call them the dog days of summer for nothing.

PS I can’t wait for Jackson Hole next week. Thursday is 12 hours on white papers on quantitative economic theory. Friday morning Fed chair Powell hopefully hits his pause button on rates. I think white water rafting is Wednesday for those central bankers seeking adventure but I am not sure.

Source: Carson, JonesTrading LLC as of August 16, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.