We’ve been talking about weak investor sentiment now dating back to last spring AFTER inflation started rippin’, AFTER the Fed finally awoke from their 2022 winter slumber, AFTER interest rates had surged, and AFTER the equity markets had sold off. SFP = sentiment follows price. Despite recent recovery in risk assets, investor sentiment still remains low. Markets need a wall of worry in which to advance – that wall of worry is weak investor sentiment and is a key underpinning to our optimistic view on risk assets at today’s prices. Warren Buffet says it best: be bullish when no one else is.

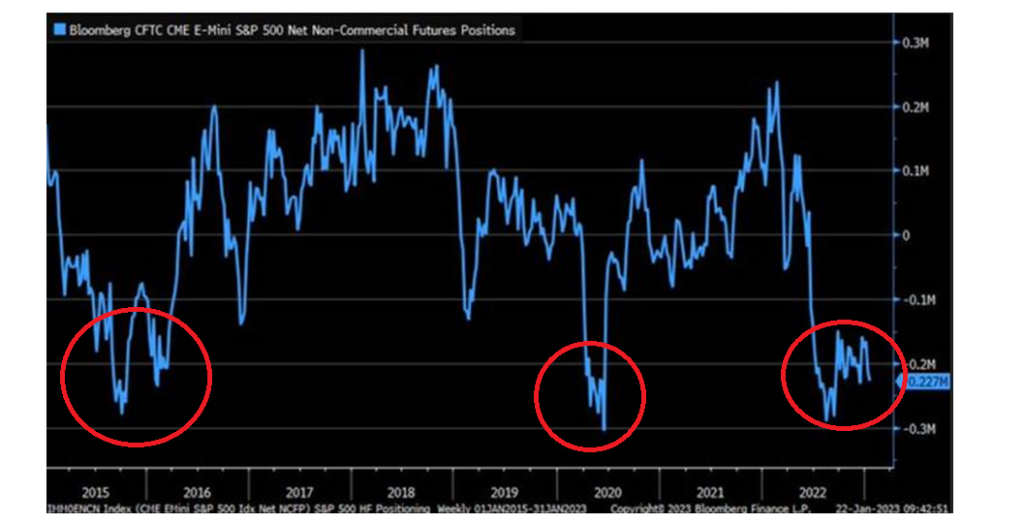

Weak investor sentiment is being joined now with “weak investor positioning”. It’s one thing to say you don’t like the market: it’s another to place a bet that it’s going down. Hedge funds are doing that now. Market rallies start to act great when sentiment is weak AND positioning is offsides (too negative). We define “weak positioning” as hedge funds being short SP500 futures, betting that the equity market goes lower. The circled areas in the chart below capture extreme moments of such weak investor positioning. Those moments look like late 2015/early 2016 (AFTER China and energy prices had cratered), the second quarter of 2020 (AFTER COVID19 had arrived and AFTER equity markets had sold off), and the last 3-6 months now (AFTER the market had gone down already because the Fed got way too far behind in early 2022).

Recession risks are very, very high. I believe that is already well-known. Corporate earnings are likely to fall in such a macro environment, also very, very well-known. But investor sentiment is weak and investor positioning already negative as the USD is now falling, interest rates are falling, inflation is cooling, and market technicals are improving. The best opportunities for the near/intermediate term are things that were very unpopular the past few years: value > growth stocks, small cap > large cap tech, non-USA v USA, emerging markets, and China (where a massive wave of COVID is likely to happen post Lunar New Year holiday).

Volatility brings about opportunities.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.