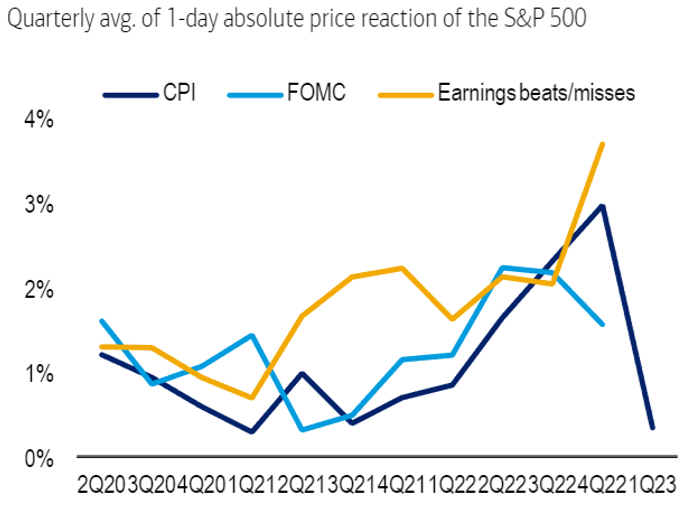

In 2022, investors were hyper focused on inflation and the Fed, so much so that bad news (on the economy) was often met with a positive reaction by the stock market, in as much as it implied falling inflation and a quicker end to the Fed’s tightening campaign. As we changed the calendar to 2023, with inflation falling rapidly and a near-term Fed pause now widely expected, investors are turning their focus to the economy and earnings, trying to assess the damage that a year of breakneck-paced rate hikes will bring to corporate America’s bottom lines. Already just a few weeks into 2023, we are seeing the market react more strongly to earnings surprises than to inflation data and Fed decisions. It seems that bad news is back to being bad news for a while.

Speaking of earnings, we are currently in the midst of reporting season for 4Q 2022. With 110 companies (22% of the index) having already reported results as of yesterday, aggregate sales are coming in 3.8% higher than the same quarter a year ago, but aggregate earnings are on track to come in 5.1% lower compared to the same period. With the economy growing at a still solid 2.9% annualized pace in 4Q 2022 based on data released this morning, the earnings decline we are witnessing so far is mostly the result of inflation starting to eat into profit margins and of tough comps from the prior year (in 4Q 2021 the economy grew at a whopping 7% annualized pace). Unfortunately, the full brunt of one of the most aggressive Fed’s tightening cycles in recent history, and of the recession that it is likely to bring about, is yet to be felt across the economy. We expect earnings will remain under pressure at least through the first half of the year, before staging a recovery towards the end of the year.

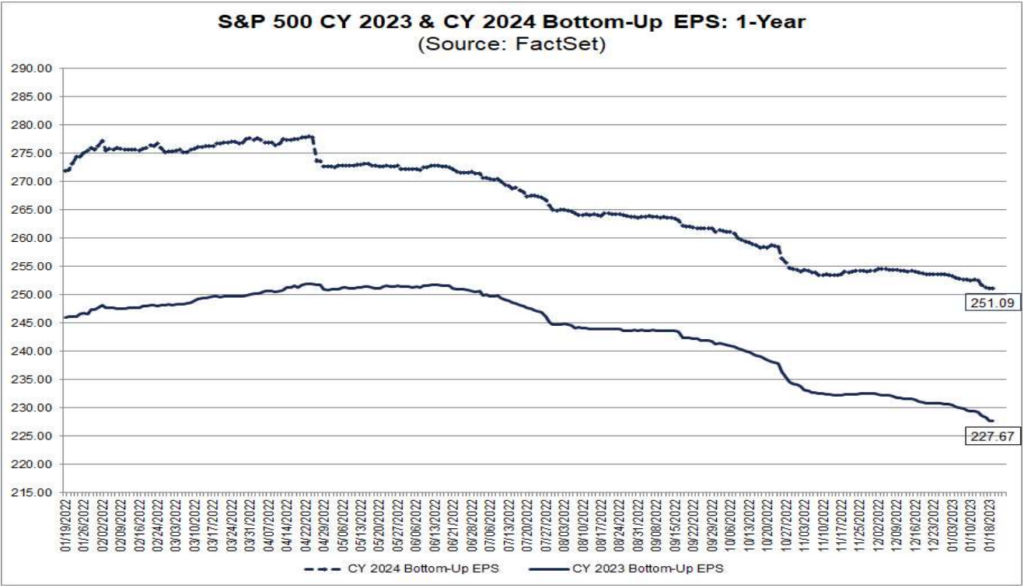

The good news is that the market has already priced in a significant earnings slowdown. Bottom-up analysts estimates have already fallen from a peak of ≈$252 to ≈$228 (-9.5%) for 2023 and from a peak of ≈$278 to ≈$251 (-9.7%) for 2024. The bear market the S&P 500 went through last year happened at least in part due to lower earnings expectations for this year. While volatility will likely remain elevated as those expectations turn into reality, the chance to see significant further declines should be limited given all the pessimism already reflected in stock prices. Most importantly, the market will begin to sniff out the earnings recovery well before it actually materializes, which means that this bear market should be living on borrowed time.

Banks took center stage last week, now it is Tech’s turn. The next two weeks will be the busiest of the season. We will get a lot more clarity on how 4Q 2022 went, but most importantly on what to expect for 2023. Stay tuned.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.