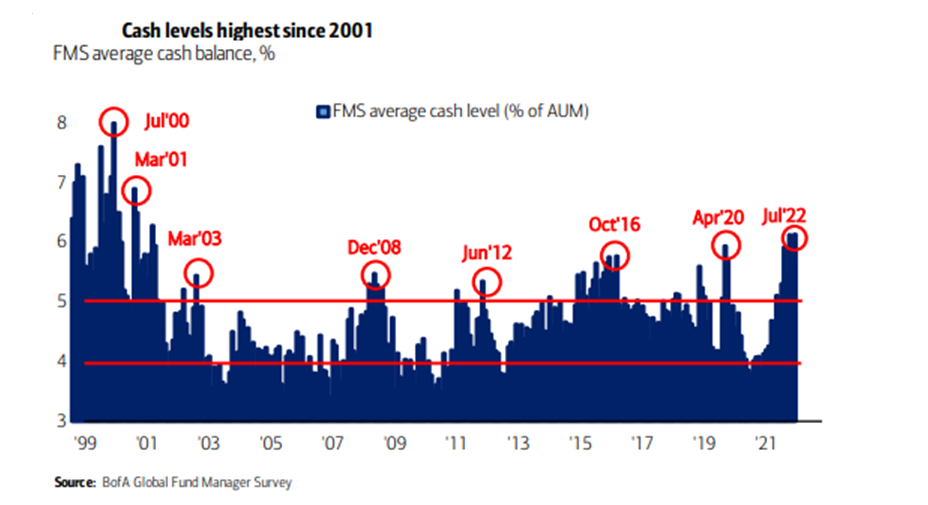

Volatility fatigue led to extreme weak investor sentiment which has now finally translated in defensive portfolio positioning. Actions speak louder than words. Fund managers surveyed have now taken up their cash balances to extremely high levels. Phenomenal counter indicator. Historical forward returns from high levels of cash are well-above average.

| JUL 2000 | Adelphia Communications fraud had already occurred |

| MAR 2001 | WorldComm accounting fraud already happened |

| MAR 2003 | At the absolute bottom of the stock market sell-off and the start of the HY bond market recovery |

| DEC 2008 | Post Lehman bankruptcy and Great Financial crisis |

| JUN 2012 | Panic after Eurozone debt crisis |

| OCT 2016 | Pre presidential election positioning (market ripped higher after election) |

| APR 2020 | After COVID happened |

| JUL 2022 | Inflation and a slow-moving Fed already underway |

Friends – everyone should view significant cash balances as an enormous bullish sign. Volatility fatigue has finally produced some selling and more cash. This is the most bullish thing I have seen in the markets in 6 months. Finally…..the best and brightest went to cash.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.