It’s my belief the Fed will hike one final time at their late July meeting and then go on an extended “pause”. Higher rates, tighter financial conditions, and ongoing quantitative tightening (code name for the Fed balance sheet shrinkage program) is slowing both the economy and the level of inflation. The UST yield curve has been inverted for 11 months now. That inversion acts as the brake for the economy and it works with a lag effect. The fastest rate hiking cycle in history is nearing its end.

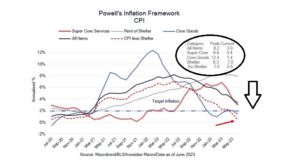

Below is a snapshot of all the inflation measures Fed chair Powell likes to quote in his press conferences, Congressional hearings, and the odd backyard cookout to anyone who will listen. These inflation readings are all down a lot with the noticeable laggard being shelter costs. Those costs are about to fall too as real-time rental data is cratering and enormous multi-family apartment supply looms. I think it’s a final hike in July and then Powell & Co. will use their annual August Jackson Hole summit to declare the war against inflation is nearing an end.

After July, the Fed doesn’t vote again until September – any hike then or thereafter risks the possibility of what they are marching towards right now: a soft landing for the economy.

P.S. The bond market is starting to see this scenario play out as well. The 2y UST spiked to 5.1% just eight days ago on a strong ADP payroll. The past week has seen a soft jobs report last Friday and several soft inflation readings this week. The 2Y UST now stands at 4.7%. It wants to go lower.

Source: Referenced above as well as JonesTrading LLC as of July 13, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.