The events of the past 10 days – including the collapse of Silicon Valley Bank and the extraordinary measures enacted by the Fed to protect/quasi guarantee deposits of any shape or size – has resulted in above-average market volatility (which I think after 15 months of such we are all pretty done with), a collapse in UST yields (virtually guaranteeing that a recession is at our doorstep), and more questions about what the Fed will do at their all-important meeting Wednesday regarding rates. In such times, a look at history does help.

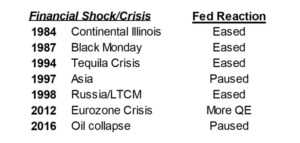

Over the past 35 years, the market has absorbed eight major, out-of-the-blue, sizable financial shocks. We are talking about “shocks” here, not natural economic recessions nor the working off of market excesses. Please note that this list DOES NOT include the recession of 1991, the tech/telecom recession of 2002/2002 (Enron, WorldCom, Adelphia Communications etc., etc.), nor the Great Financial Crisis of 2008/2009 (housing, mortgages, the demise of Lehman). In my opinion, those instances all had more to do with market cycles and overinvestment in various forms – regional real estate 1991, tech/telecom boom 2001, the housing ramp and plummet of 2005-2008. This list is about SHOCK. SHOCK means things are ok one moment and not ok the next. The seven instances listed below are a pretty exhaustive list of shock, ranging from the Black Monday October 1987 market collapse to the Long-Term Capital Management implosion of August 1998 to the energy industry selling off -70% in two months during early 2016. What these shocks all have in common is that the Fed eased policy in the face of shock each and every time. The 8th instance is COVID and the spring of 2020 when the Fed just didn’t ease rate policy down to zero, they also embarked on the single greatest monetary stimulus package since FDR’s New Deal in 1933/1934. When hit with shocks, the Fed has a long and glorious history of “pausing” with regards to rate policy.

Tomorrow the Fed will meet and they will vote on whether or not to hike rates. Market odds at present are that a 25bp rate hike tomorrow is a coin flip, basically even odds on each side. My own belief is that recent economic data supports hiking rates 25bps but that the collapse of SVB will force the Fed to defer a rate hike until May at the earliest. You can’t be hiking rates mid-week and the running around each weekend brewing up emergency deposit protection plans. The Fed can’t be hiking rates at their meeting held on the 7th floor of the Federal Reserve building while down on the 4th floor Treasury chair Janet Yellen is supplying regional banks with an extra $140 billion of liquidity from the Fed’s discount window. The Fed can’t be doing quantitative tightening and attempting to shrink their balance sheet while simultaneously taking Treasury collateral to support emergency demand for deposits. They can vote however they want to vote, but it would seem hiking rates in the face of a banking crisis goes against both past history and common sense. The banking system needs more liquidity right now, not less. I hope the Fed is not tone deaf to that reality, but we’ll know for sure Wednesday after lunch. Enjoy the show.

Source: EISI as of March 14, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.