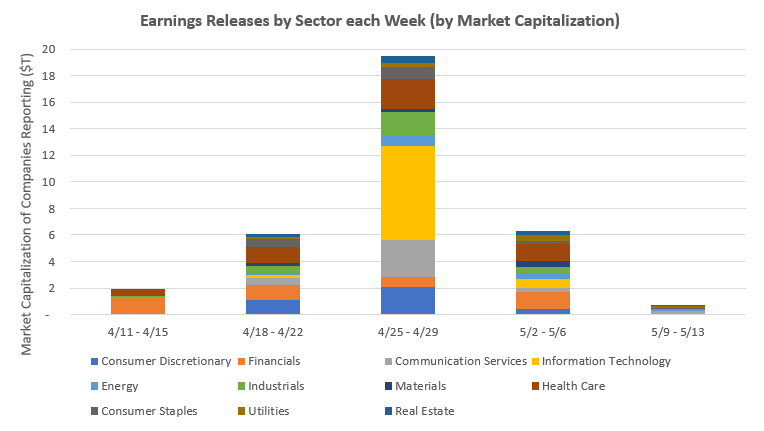

Earnings reporting season for Q1 2022 is about to kick off. As usual, the first week will be dominated by financial heavyweights such as J.P. Morgan, Bank of America, Wells Fargo, and the likes, which will give us a first taste of how corporate America fared during this tumultuous quarter. Week two will see most other sectors join the party, but reporting will really kick into high gear in week three, when nearly $20 trillion worth of market capitalization of the S&P 500 will release results for the quarter. Week three will be dominated by technology behemoths such as Alphabet, Microsoft, and Meta.

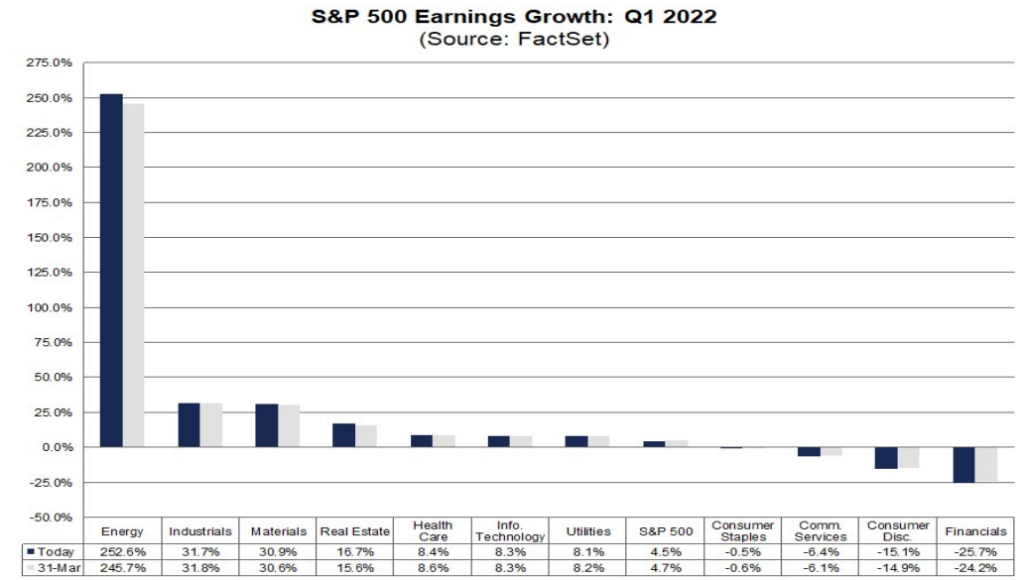

While analysts have been turning more cautious and revised estimates lower over the past couple of months, aggregate S&P 500 earnings for Q1 2022 are still expected to come in 4.5% higher than the same quarter a year ago. If history is any guide, however, actual results are likely to come in higher than that, as companies tend to set the bar low in order to generate positive surprises for investors. For instance, over the last ten years, actual earnings reported by S&P 500 companies have exceeded estimated earnings by 6.5% on average, with 72% of companies in the index beating estimates. If we assume Q1 2022 will be an average quarter in terms of surprises, then actual earnings growth for the quarter may end up exceeding 10%, which would mark the fifth consecutive quarter of double-digit growth.

From a sector perspective, Energy is expected to stand out, with estimated earnings growth exceeding 250%. This should come as no surprise as the sector has been reaping the benefits of oil prices having surged from about $60/bbl a year ago (and <$0/bbl two years ago!) to about $100/bbl today. At the opposite side of the spectrum, Financials are expected to report the worst earnings growth of -25%. However, that is mostly due to banks going from releasing COVID-related loan loss provisions last year (thus artificially inflating earnings) to setting aside loan loss provisions today (thus artificially deflating earnings). As usual, analysts are likely to pay little attention to these one-time effects and focus more on lending growth and net interest margins, which should have improved in recent months. We will find out soon.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.