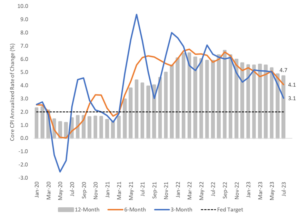

Fresh data released this morning points to continued progress on the inflation front. According to the Bureau of Labor Statistics (BLS), both the overall Consumer Price Index (CPI) and its core version (which excludes the often-volatile food and energy components) increased by just 0.2% in July, a level that is roughly consistent with the Fed’s 2% target. July marked the second consecutive month of 0.2% increases in the core version of the index, which the Fed tends to pay more attention to. As a result, while the core index is still an uncomfortable 4.7% higher compared to a year ago, its 3-month rate of change has now plummeted to 3.1%, which is the lowest in almost 2 years. It should be just a matter of time before the year-over-year measure follows in the same direction.

Core Inflation Falling Rapidly

Source: Congress Wealth Management, Bloomberg, as of 8/10/2023

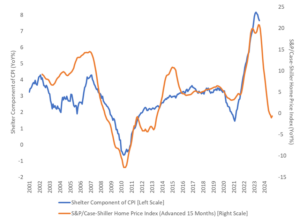

According to the BLS report, the shelter component of CPI confirmed its role as one of the most important factors keeping inflation elevated, being responsible for roughly 90% of the increase in overall CPI for the month of July. This is due to the fact that shelter makes up roughly a third of the overall CPI basket, and that it keeps running hot: it increased 0.4% from the prior month (which annualizes to 5.4%) and remains 7.7% higher compared to a year ago. However, as we have pointed out in the past, the BLS’s measure of shelter costs significantly lags conditions on the ground. According to real time indicators such as the S&P/Case-Shiller Home Price Index, housing inflation has been virtually non-existent for more than a year. The shelter component of CPI should begin to reflect this reality going forward, which will weigh heavily on both overall and core CPI.

Shelter Disinflation is Just Getting Started

Source: Congress Wealth Management, Bloomberg, as of 8/10/2023

While there are still a few important data releases before the next Fed meeting in September, today’s report increases the chances that we may have already seen the last rate hike of this cycle. This is consistent with the odds of a September hike implied by the futures market, which have fallen to just 10% this morning from 28% a month ago.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.