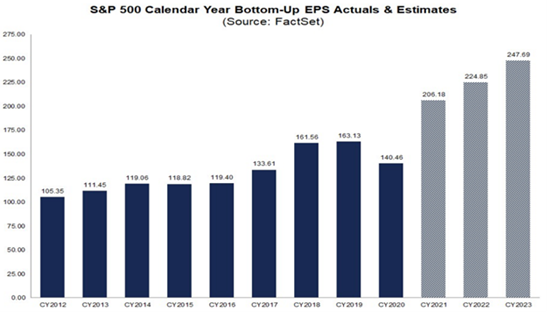

With 56% of companies (worth 73% of market capitalization) of the S&P 500 index having reported results for Q4 2021, it is shaping up to be another remarkable quarter for corporate America. Compared to the same period last year, sales for S&P 500 companies are coming in 16% higher, while earnings are coming in a whopping 27% higher. This implies that profit margins have been rising, which is no easy feat with inflation running at a 40-year high, and suggests companies retain strong pricing power. If these numbers hold through the end of reporting season (and estimates suggest they may even improve), then this would be the fourth straight quarter of earnings growth above 25%. The last time this happened was between Q4 2009 and Q3 2010, not surprisingly at a time when the economy was recovering from another severe recession.

While that record is likely to end at four quarters once again, earnings growth is expected to remain very strong going forward. Despite all the equity volatility so far this year, analysts haven’t turned any less optimistic on the outlook for earnings. In fact, forward-looking estimates have actually increased since the start of the year. The latest bottom-up estimates point to earnings growing by about 10% per year over the next two years. While that is much lower than the unsustainable 25+% growth we have enjoyed over the last four quarters, it is much higher than the long-term average earnings growth rate of about 6% per year. Given a backdrop of a synchronized global reopening, plentiful liquidity, strong consumers and no recession in sight, we see no reason why those expectations should be disappointed.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.