Fears of a major conflict between Russia and Ukraine/NATO intensified over the past week as White House officials urged all U.S. citizens to leave Ukraine as intelligence suggests ‘major military action very soon’. Of course, diplomacy can, and we hope, prevail but in case it does not we wanted to look at the effects war has on the stock market. The conclusion is stocks tend to have drawdowns but that the old adage ‘sell the rumor, buy the news’ is the historical pattern.

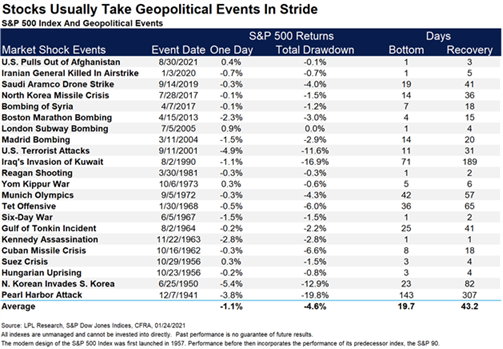

The study below from LPL Research shows drawdowns and days until recovery (the length of time to recover all losses from the drawdown). S&P 500 drawdowns tend to be very shallow with the average drawdown of 4.6%. There were a few outsized losses with 2001 and 1990 standing out but those were during recessionary economic periods, and right now our economy is very strong. With the small losses, the recovery time to recoup the losses was also very small at 43 days on average.

Additionally, we analyzed data from Ned Davis Research on forward S&P 500 returns from the event date. On average, the S&P 500 gained 5.10% over the next 63 days and 8.35% over the next 126 days.

This is not meant to downplay the seriousness of this situation. Specifically with Russia, there could be major disruptions to commodity markets, and energy markets more precisely, which could cause greater drawdowns than the historical averages. However, analyzing historical periods of conflict equity markets tend to take it in stride as the advancing economic locomotive and earnings growth win out.

Sean Dillon CMT, CFTe®

Vice President of Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.