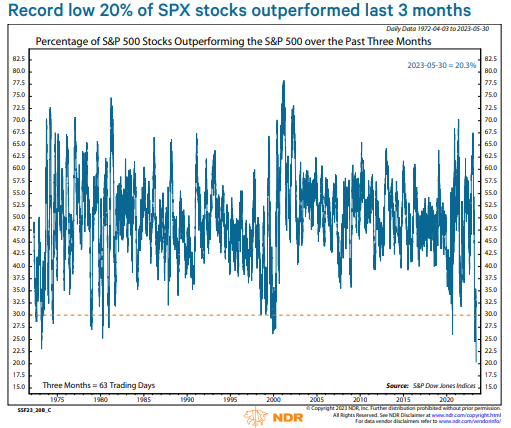

Much has been written over the last few months about the narrowness of the market (poor breadth). The S&P 500 is up 12%+ year to date but there have been relatively few outperformers; a handful of ‘AI’ related stocks have soared while the remaining stocks in the S&P are flat on the year. This market action is causing some extreme readings with a record low percentage of stocks that has beaten the S&P over the last 3 months, and lowest for a calendar year, so far.

Source: NDR, as of 5/31/23

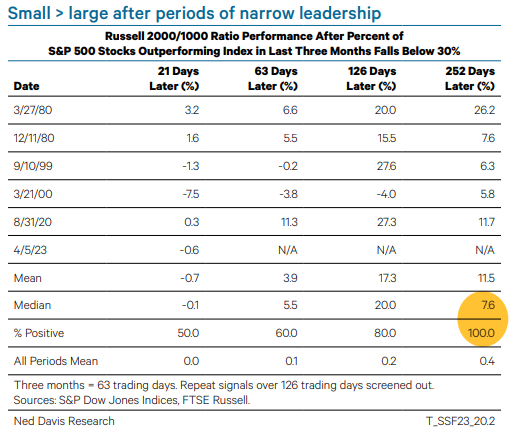

Sure, this could be a major warning, but we believe this is just market rotation and another rotation should occur in the near future. Historically, the data is on our side in this thinking, and tremendous opportunities are presenting themselves.

One such opportunity is in small cap stocks. When leadership has been this narrow in the past, small caps outperform large caps 80% of the time over the next 126 days and 100% of the time over the next 252 days. That’s a pretty good track record.

Source: NDR, as of 5/31/23

And if we look at this data slightly differently, the return numbers for small caps are staggeringly high. The chart below compares the distance to a 2 year high between the S&P 500 and the Russell 2000. The S&P 500 is about 11% from a new high and the Russell 2000 is about 27% from a new high. That spread is 16% or so, and one of the largest differences on record. The sample size is small at only 2% of observations below 15% but in that zone the annualized forward returns for the Russell 2000 is 115%! Extreme moves create extreme opportunities indeed.

Source: NDR, as of 5/31/23

Sean Dillon, CMT, CFTe

SVP, Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.