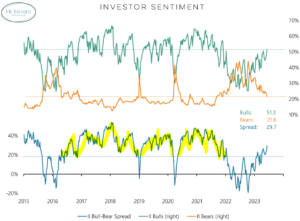

The S&P 500 is up 20% from the October lows and predictably more and more investors are bullish on continued gains. Price leads sentiment.

The latest AAII survey published yesterday shows the largest number of bulls in a year after a massive 15% jump to 44% from just the previous week, while bearish sentiment plummeted to 24%. Compare that to the week ending 9/21/22 (close to the bottom in stocks) when 60% of investors were bearish.

Source: American Association of Individual Investors, as of 6/7/2023

Looking more wholistically at sentiment with measures from BofA, Goldman, equity flows, and Investors Intelligence to name a few, we can say that investors are no longer historically pessimistic. And quite frankly, that’s a good thing. Bull markets need bulls.

Here is the Investors Intelligence survey going back a few years. I crudely shaded in yellow the times when there were 20% more bulls than bears according to this survey. These were fantastic times to be an equity investor with gains of roughly 40%, 25%, and 65% in the S&P 500. If prices continue to rise, more and more investors will become optimistic. It’s natural. And at some point, in the future, we have to watch for the opposite signs – euphoria. But that is seemingly a ways away.

Source: Hi Mount Research, as of 6/6/23

Source: Stockcharts, as of 6/7/23

Sean Dillon, CMT, CFTe

SVP, Investment Strategy

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.