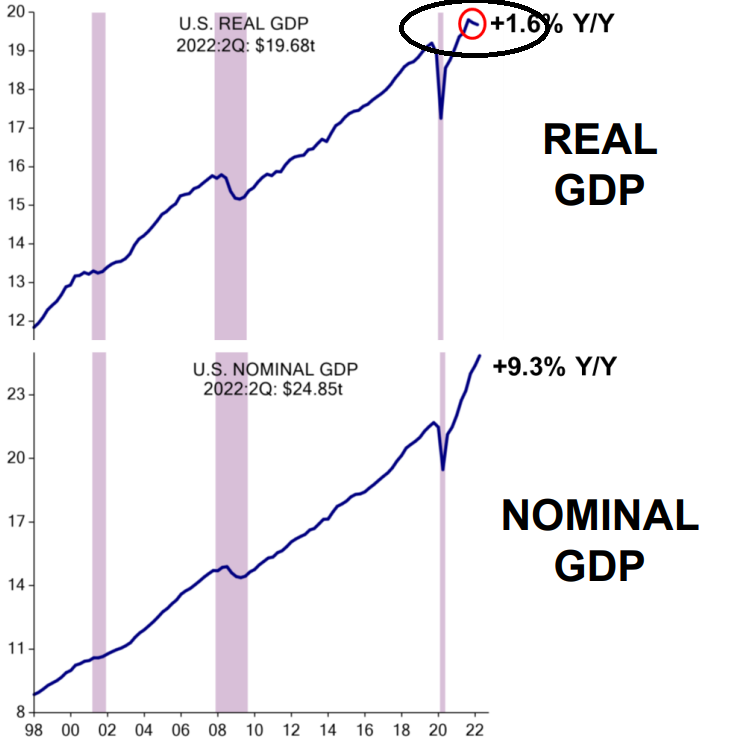

This morning’s GDP report noted contraction for the second quarter in a row. We can debate inventory builds and trade imbalances and the math underlying the calculation of real GDP, but the official number says negative real GDP growth for a 2nd quarter in a row and the textbook defines that officially as a “recession”.

Looking at a lot of the other data and looking at and experiencing the economy right now, it certainly doesn’t feel like a recession. Labor strength and consumer spending – still strong. High yield bond defaults – nonexistent. Airplanes full, traffic everywhere. Real GDP might have reversed for a few quarters but the overall economy (as measured by nominal GDP growth) looks really strong. If this is recession, it’s unlike one we have ever experienced before.

Financial conditions have tightened a lot and economic demand is being destroyed by these tighter conditions and higher rates. We all see that. Fed funds futures have come in (lower) 7-8bps this morning. The Fed doesn’t vote in August but the probability of just a 50bp hike in September, rather than 75bp, has increased. If the economic data continues to come in soft – and it should – the Fed could be in pause mode come October. Risk assets are waiting for that moment. The pivot in policy will come with the announcement of a “pausing”.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.