Over the past month or so, we’ve survived 3Q22 earnings season and a fairly major Fed announcement. Not small things in a year filled with volatility but both of those were good/ok. Corporate earnings have hung in reasonably well despite a lot of demand destruction this year by the Fed (those earnings likely go sideways or lower in 2023) and the Fed created an out for themselves with regards to monetary policy in case the economy weakens and inflation slows (also very likely in 2023).

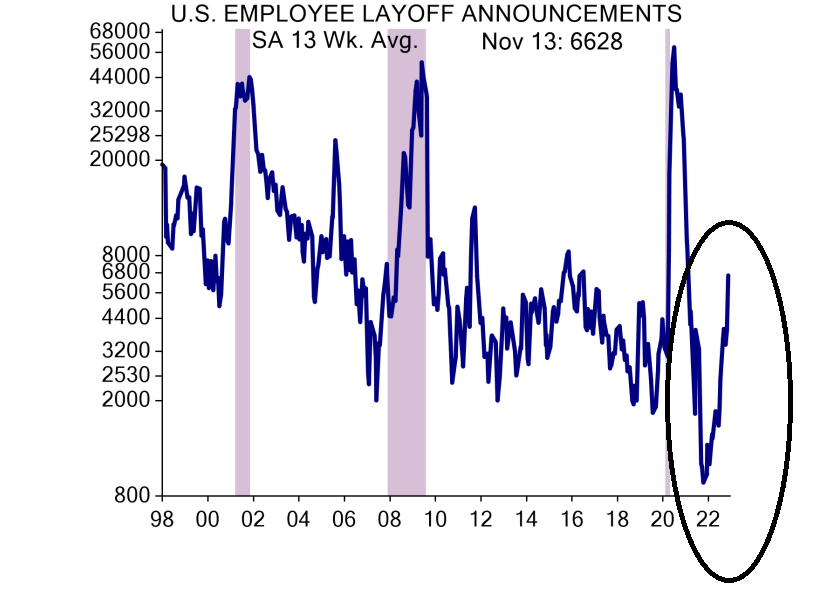

The Fed just hiked short rates +75bps but the 10Y UST yield has fallen -75bps in two weeks and that is a big deal. Short rates now hover around 4.5% and longer 10Y UST rates now linger at approximately 3.75%. The yield curve is comfortably inverted and recessionary risks are real. What is a lower yield on the 10Y UST possibly telling us about the future? I think its saying that if 2020/2021 was about COVID and money printing, and 2022 was about inflation and a Fed that got too far behind, then 2023 might be about an implied drop in forward economic growth. Housing and homebuilding have basically already been stopped in their tracks and although retail sales this morning were solid, weakness is emerging in the labor market and layoff announcements are up and up A LOT. In order to get the Fed to slow their pace of rate hikes/pivot, we need inflation to continue to slow and the labor market to weaken. That process is underway.

The good news, strangely, is that the market has already sold off a lot and investment sentiment is already extremely bearish. We’re closing in on 33 months into this pandemic and while many lessons have been learned, one certainly is that this cycle is different. Up is down and down is up. The 10Y UST is telling us something and that something I believe is that forward economic growth is going down, inflation likely falls as well and current Fed policy needs an adjustment. Good news is now bad news, and vice versa.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.