Back-to-school day in Boston, opening night for the NFL, and three charts for your Thursday morning!!! LET’S GO!!!

Chart#1 – Temporary job growth rolling over: A deeper dive into last Friday’s non-farm-payroll data noted that temporary jobs appear to have peaked and are now rolling over. History says first temporary jobs go, then wage growth goes, then jobs go. All a function of higher rates and tighter financial conditions more broadly. Monetary policy works with 12-18 month lags and we’re about to start feeling the job market go slower-er.

Source: BLS Data as of September 2, 2023

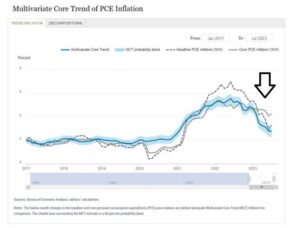

Chart #2 – Personal consumption inflation on a notable downtrend, too: 15 months ago PCE inflation data was running close to 6%; today its 3% and trending down and trending down fast. Again, monetary policy and higher rates work with a 12-18 month lag. Inflation is headed lower and there’s an excellent chance the Fed is done with rate hikes for this cycle. Every crisis has an ending – this inflation crisis and the Fed’s 2021/early 2022 policy error crisis might be done.

(p.s. if you can’t sleep or are having trouble sleeping, looking at a little multivariate core trend PCE inflation data works like a charm every time).

Source: Bureau of Economic Analysis as of July, 2023

Chart #3 – And, last but not least, don’t give up on a bull market just because the dog days of August set in. In the past 70 years there have been 10 years in which the equity market had a big six months of the calendar year and then modestly retreated in August. Don’t look at the September data below – look at the September thru December data below. Investors have a habit of chasing up markets later in the year. In the words of Bill Belichick, “we’re onto September”.

Source: Carson Investment Research, FactSet as of September 2, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.