Another theme we expect to play out in 2023, and possibly beyond, is the outperformance of value stocks over growth stocks.

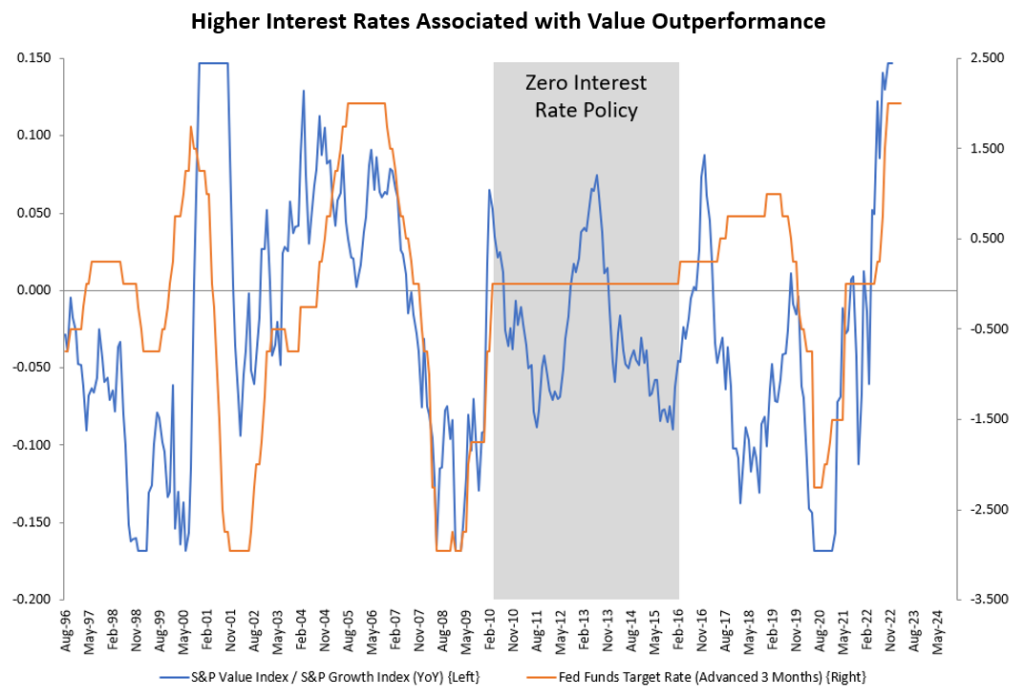

First, let’s get definitions out of the way. As the name itself implies, growth companies are expected to grow their revenues and earnings at a faster clip than that of the overall market. For this reason, they typically demand a valuation premium (i.e. they trade at a higher multiple). Growth stocks usually don’t pay any dividends and may even be currently unprofitable but have the potential to deliver large payouts in the future. As such, they are often thought of as long duration investments, which makes their valuation particularly sensitive to interest rates. Examples of industries with a high concentration of growth stocks are biotechnology, software and internet. At the opposite end of the spectrum, we find value companies. These tend to be more mature, dividend-paying companies that face less promising growth prospects, and thus tend to trade at lower valuations. Value stocks can be thought of as low duration investments because a large portion of their payouts to investors will occur in the near future. Examples of industries with a high concentration of value stocks are banking, retail, oil & gas.

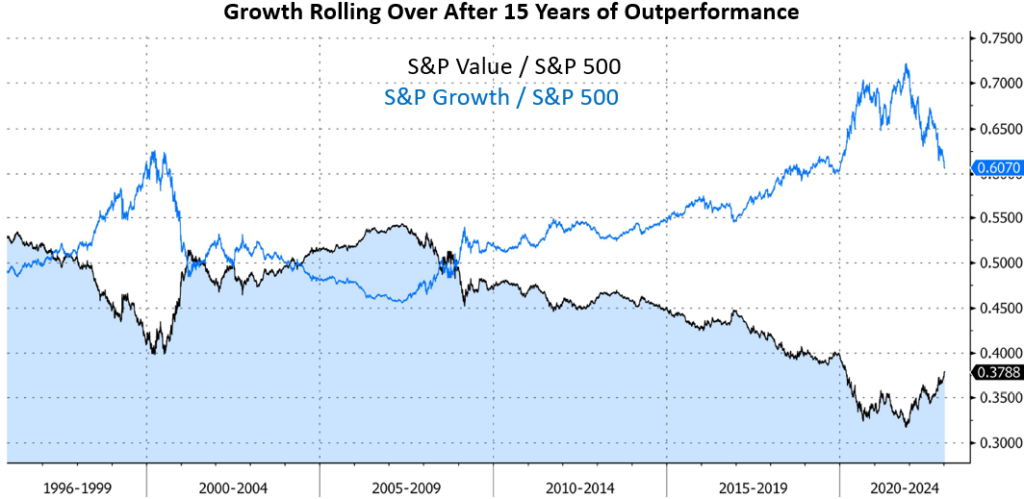

Following the global financial crisis of 2008, we had a roughly 15-year stretch during which the macroeconomic environment was particularly favorable to growth stocks. The recovery coming out of the crisis was lackluster, with the economy growing below its potential for many years. When growth is hard to come by, investors are willing to pay up for it wherever they can find it, and so they bid up the valuation of growth stocks. This trend was supercharged by the very low interest rate environment that prevailed at the time, which brought the time value of money to essentially zero, causing $1 tomorrow (or far into the future) to be just as valuable as $1 today. That 15-year period of outperformance culminated in the COVID-19 pandemic, which resulted in the so-called stay-at-home bubble. Companies that were able to operate in and even facilitate the remote economy (e.g. internet and software companies such as Amazon and Zoom) received a boost. Meanwhile, companies whose business model depended on people leaving their home (e.g. retail and energy companies such as Macy’s and Exxon) struggled. This distinction overlapped pretty closely with the one between growth and value stocks, causing the divergence in their relative performance to widen even further.

Fast forward to today, and the macroeconomic environment has changed dramatically. The economy is growing above potential, as evidenced by employers struggling to find workers. Such strong and broad recovery has allowed even value companies to deliver above-average levels of growth. Interest rates are near the highest they have been in over a decade, making future profits much less valuable than current profits, thus putting long-duration companies at a disadvantage. The stay-at-home bubble is popping, with consumers increasingly diverting their spending towards services such as travel and entertainment, at the expense of gadgets such as laptops and exercise equipment. As a result, the gap in relative performance between growth and value stocks has begun to close, but we believe it has much further to go.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.