While the excessive money printing and fiscal stimulus of 2021 is the primary cause of above trend/pronounced inflation, it’s the Fed’s lack of action in early 2022 with regards to monetary policy and fed funds rate hikes that is the primary source of the current market volatility.

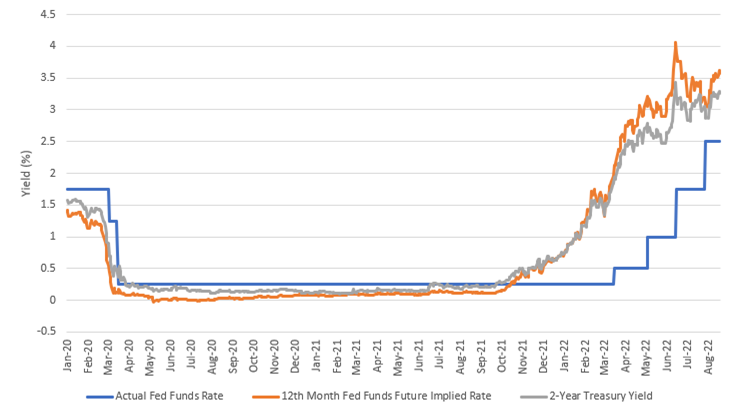

The dark blue line below is the official fed funds rate and the orange/grey lines are the “market rate” for shorter-dated interest rates. The orange rate is the implied Fed funds futures rate 12 months out and the grey line is the 2y UST. Both of those are good proxies for where the market thinks short-dated interest rates should be. The chart below notes that the Fed lost control back in November/December 2021. Up until then, the fed funds rate, the fed funds futures rate, and the 2y UST were in harmony (all roughly the same). When inflation started to develop late last year, the market raised rates aggressively and the Fed acted too slow. The gap between the orange/grey lines and the official rate (dark blue) widened substantially. The Fed has been playing catch-up for much of the past six months, but progress does eventual come.

While the market rate remains above the Fed funds rate, that should all change in the coming 2-3 months. The Fed won’t hike rates in August (they will be busy white water rafting at their annual Jackson Hole symposium), but they will hike rates in both September and October. The Fed will likely hike a cumulative 100bps between Sept/Oct and that will get official fed funds rates back to where the market thinks they should be. Markets will like this because the Fed and the market will once again be in sync.

As summer turns into fall, the market will be looking for two things in particular: steadily declining inflationary pressures (already underway) and Fed chair Powell utterance of the magic phrase with regards to additional rate hikes: “we are pausing”. You can’t have a soft landing for the economy without both of those things happening.

All of this can be filed under “Coming Attractions Autumn 2022”.

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.