At the beginning of April, the 10-2 year yield curve briefly inverted, creating widespread hysteria in the financial media. However, despite what you may have been hearing or reading, an inversion of the 10-2-year yield curve does not necessarily mean that a recession is imminent. Historically, a 10-2-year yield curve inversion has provided one of the earliest warning signals, sometimes preceding a recession by as long as 2 years and 10 months. And as we have shown in a prior note, stocks can perform quite well for some time following an initial inversion. As such, we will need to see more evidence fall into place before we can confidently determine that it is time to prepare for a recession.

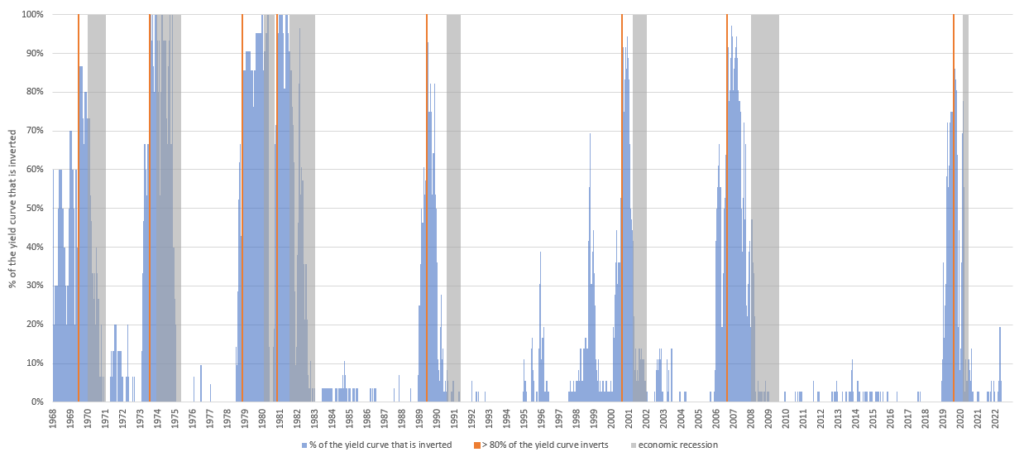

One confirming piece of evidence that we will be watching closely is whether the inversion of the 10-2-year spread begins to extend to other maturities along the curve. The indicator shown in blue in the chart below measures the percentage of all yield spreads ranging from 1 month to 10 years that is inverted. Based on our research, we found this indicator to be a more reliable recession forecasting tool than the yield curve itself. Historically, no recession has ever occurred without 80% or more of the curve being inverted first, with a recession occurring 10 months later on average. Today, after a brief spike to just below 20% at the beginning of April, the indicator has fallen down to 5% thanks to the re-steepening of some parts of the curve, including the infamous 10-2-year spread. With the shorter segments of the curve still at very steep levels, it could take some time for this indicator to cross above 80%. Until then, recession risk remains low.

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.