Elevated inflation and a Fed that is way too far behind the curve is where we find ourselves today. The Fed most likely will hike rates 75bps on Wednesday – it’s... read more →

Economist Milton Friedman and I have many things in common,. We both believe that inflation is driven by the excess supply of money. More dollars chasing the same amount of... read more →

A few takeaways from this morning’s payroll report: Payroll employment with revisions increased +368k……still hotHousehold employment increased +320k……still hotUnemployment rate held at 3.6%…..near generational lows Nothing in this data is... read more →

Corporates insiders have an unusually good track record of timing their personal buys/sells. There’s a process around their trades and they do have to jump thru regulatory hoops and various... read more →

Over the past several months we have talked often about the root cause of the current inflationary environment. We can argue at the fringe about supply constraints etc. but at the... read more →

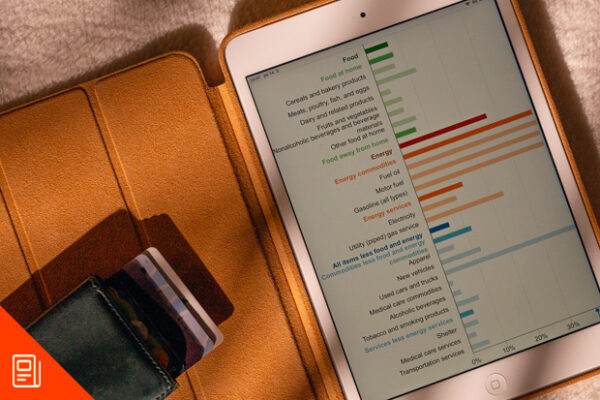

Last week’s Consumer Price Index inflation data noted elevated levels of inflation but also some signs that inflation may be near to peaking. Financial conditions (stock market selloff, higher mortgage... read more →

There have only been 12x in the past 60 years in which greater than 93% of the trading volume of the SP500 was negative for two out of three days. Only... read more →

Yesterday afternoon big risk rally was a pleasant break. The market came into Powell’s press conference oversold, looking for a reason to go higher. Powell’s somewhat dovish comments just enough to perk... read more →

In March 2009, US unemployment rate was around 10%, the global credit markets were completely frozen, high yield bond defaults were around 11% of the HY market (record default ratio),... read more →

Market Last week’s AAII Bull/Bear reading of just 15.8 was the LOWEST reading since 1992. Bears greatly outnumber Bulls. A lower reading than the darkest days of 2008-2009. Lower than when we... read more →