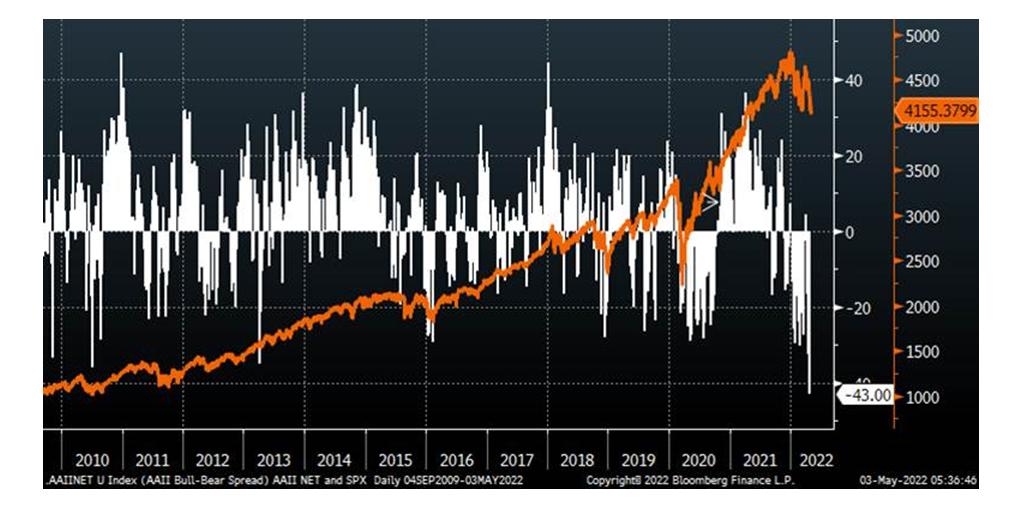

In March 2009, US unemployment rate was around 10%, the global credit markets were completely frozen, high yield bond defaults were around 11% of the HY market (record default ratio), and the S&P500 stood at approximately 666 in early March 2009. Sentiment then was EXTREMELY bearish as measured by the AAII Bull/Bear ratio…and for good reason.

Today the unemployment rate is at <4%, the economy is humming, corporate earnings have been solid, 29 deals merger/acquisitions deals announced this week of at least $5 billion in value each, airline flights are full, you can’t get into a restaurant, and traffic is back to worse than pre-pandemic levels here in Boston. None of that matters right now. Until the Fed starts to go faster with regards to rate hikes, the market will continue to experience above average volatility.

Investor sentiment is a great counter indicator, and it is flashing EXTREME again. Perhaps beyond extreme. The Bull/Bear ratio is now below the reading of 2019 COVID pandemic, 2018 Fed/Powell messaging miscues, 2016 Brexit, 2015 China economic slowdown, 2013 Fed taper tantrum, 2011 US stock market flash crash, and now BELOW the March 2009 bottom of all global risk assets during the Great Financial Crisis. In today’s market there is currently a massive disconnect between the economy, spending, a solid earnings outlook, and the equity market.

Forward risk assts returns from EXTREME readings of bearishness have historically proven to be above average looking out 6mos, 12mos, 24mos, 36mos.

Construction spending looks to be slowing and some ISM manufacturing prices paid data looks like inflation pressures are peaking. I am not quite ready to call “inflation has peaked” but it certainly feels like inflation may have peaked.

Bull/Bear ratio now more bearish than March 2009 – the darkest days of the Great Financial Crisis

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.