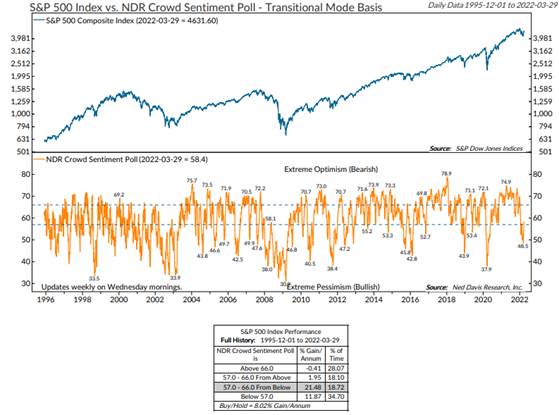

The NDR Crowd Sentiment poll below measures market based and survey-based sentiment indicators to gauge if investors are optimistic or pessimistic. As mentioned, a few times over the last month investor sentiment was very pessimistic which is usually a great indicator of strong future returns. Especially if investors are pessimistic but sentiment starts to improve as the grey box indicates. Not surprising that sentiment is improving as prices rise!

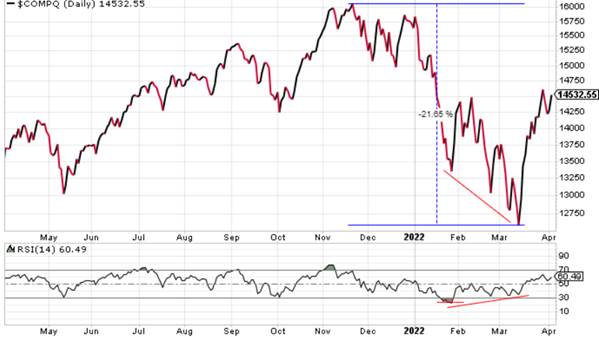

Next let’s look at the relationship between price and momentum. We’ll follow the leader of the past 10 years by looking at the NASDAQ. The NASDAQ did lead the market lower as it peaked in November, compared to the S&P in January, and fell 21% at the March low. However, as we look at momentum as measured by the RSI in the bottom panel the downtrend LOST momentum from the January low to the March low. It may be a newer concept to some but essentially this signaled an exhaustion of sellers.

Lastly let’s look at participation. Participation, or breadth, is very useful to determine the veracity of the move higher in price. When breadth is very strong after a sizeable decline, we call that a breadth thrust and once again usually signals strong forward market returns. At the March low there were less than 10% of stocks over their 10-day moving average but on this rally that number ‘thrusted’ higher to 90% of stock over their 10-day moving average. Almost all the troops are following the general in this rally and, as mentioned, according to past occurrences back to 1980 leads to strong forward returns.

Mean and Median Returns After Breadth Thrust Signal

| Summary Item | 10 Days | 21 Days | 42 Days | 63 Days | 84 Days | 126 Days | 253 Days |

|---|---|---|---|---|---|---|---|

| Mean | 0.52 | 1.80 | 3.90 | 4.65 | 5.35 | 9.75 | 16.67 |

| Median | 0.96 | 1.73 | 3.97 | 5.46 | 6.43 | 9.12 | 14.23 |

| Number Up | 27 | 24 | 27 | 26 | 27 | 30 | 35 |

| Number Down | 10 | 12 | 9 | 10 | 9 | 6 | 1 |

| All Periods Mean | 0.39 | 0.82 | 1.62 | 2.45 | 3.29 | 5.01 | 10.46 |

There is a lot of evidence mounting in defense of a bottom in prices (what’s with March bottoms!). With monetary, geopolitical and mid-term election uncertainty still present there is likely to be continued volatility but from a technical perspective moves down in price should be bought.

Sean Dillon, CMT, CFTe

SVP, Investment Strategies

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.