One of the Fed’s two jobs is to manage inflation around a long-term target (roughly 2.5%). They try to impose price stability into the economy and attempt to manage such by using their lever on short-dated interest rates. Like Novocain, it takes a while to work but eventually it works. Monetary policy does have a lag effect, roughly 12-18 mos. If last year’s story was about how far the Fed got behind inflation versus market expectations, the emerging story of 2023 is that they soon will be declaring “mission accomplished”.

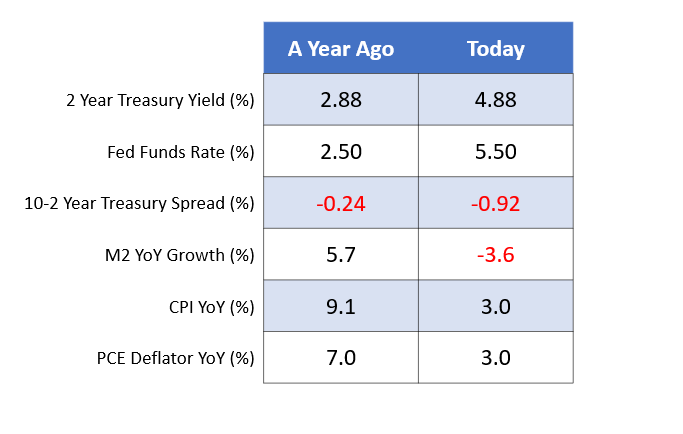

Over the past year, short-dated interest rates have increase by 200-300bps. The UST yield curve was flat a year ago; now it is sharply inverted. Money supply growth a year ago was positive; now it is sharply contracting. Tighter financial conditions have been imposed and those conditions have made great strides in arresting inflation. Core CPI and PCE deflator inflation data both down sharply. The Fed’s job is done with regards to inflation. They can take the rest of the summer off and use their upcoming Jackson Hole summit to declare victory.

PS. Please spare yourself and ignore the surprise Fitch US debt downgrade. The timing is bizarre. Only 12 years late. It was a story in August 2011 but it’s a nonstory in August 2023. The story this week is Apple and AMZN earnings after the close Thursday and Friday’s payroll report. Enjoy the show.

Source: Bloomberg as of August 1, 2023

Richard Barrett

Chief Investment Officer

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.