The S&P 500 index is roughly halfway through reporting season for 2Q results, with 282 companies out of 500 having reported results so far. Last week was the busiest week of the season, with 173 companies reporting results, including some of the largest names in the index such as Apple, Alphabet (a.k.a. Google), Amazon, Microsoft, among others. So while we are not quite at the 7th inning stretch of this reporting season, we have seen enough to have some clues as to how the game is likely going to end. Thankfully, this is not a Red Sox game, and things have been going quite well, better than expected in fact.

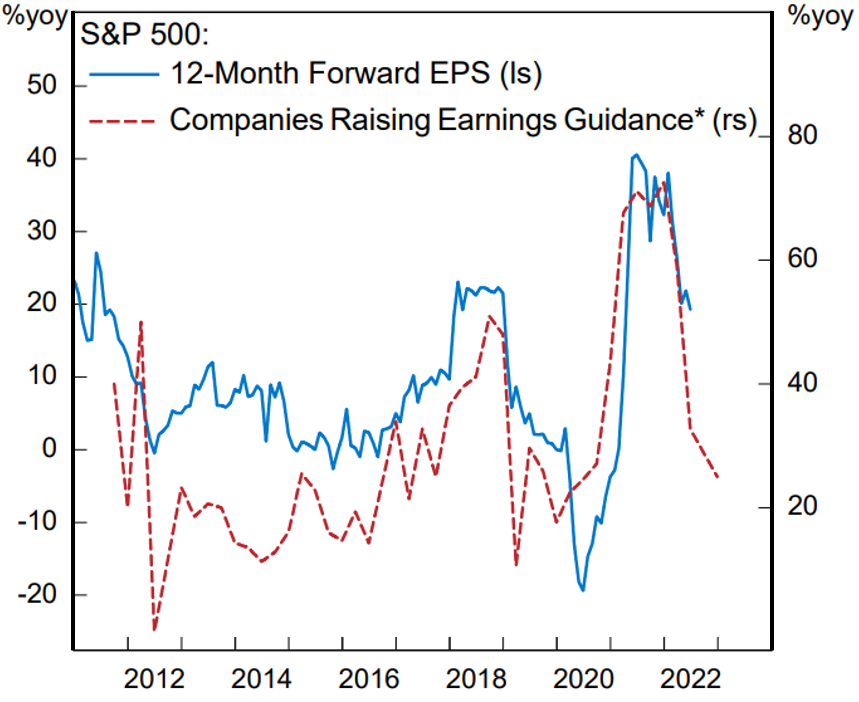

Over the last few months, we have seen a sharp negative turn in the comments as well as the guidance provided by companies’ top executives. This can be seen from the red dashed line on the chart below, which measures the percentage of companies raising their earnings guidance. Among the top concerns expressed by CEOs are high inflation, the Fed’s campaign to raise interest rates, fears of an incoming economic recession, and a strong dollar (which decreases the value of profits from overseas). Responding to such negative guidance, analysts have been aggressively lowering their estimates of earnings, as indicated by the blue line on the chart. Looking specifically at the second quarter, estimates peaked at around $56/share early in the quarter, and have since been revised to roughly $53/share (or 5.4% lower) as of last week. However, results reported so far show companies have turned out to be much more resilient than expected. Aggregate earnings have come in 5.9% higher than the same period a year ago, which is 4.2% higher than initially estimated, and the S&P 500 index is now on track to deliver the $56/share that were initially expected. These results at least partially explain the impressive rebound we have seen in stocks over the last few weeks, with the S&P 500 index seeing its strongest monthly gain since November 2020.

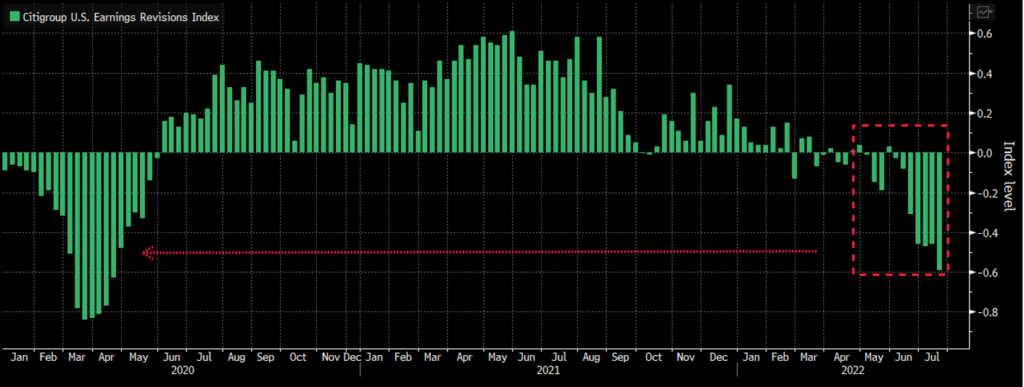

That being said, we are clearly not out of the woods yet. The risk of an economic recession between now and the next few quarters remains very real, and analysts are getting increasingly more pessimistic on earnings going forward. As the chart below shows, analysts continue to aggressively slash their estimates at a rate that is not far from the one seen during the initial Covid lockdowns. Certainly, if the economy is going to experience a recession (which seems very likely to us at this point), then earnings will likely come under pressure. However, what the chart below shows is that the market’s process of adjusting to those negative expectations is well underway. As we have pointed out a few times already, there is a lot of pessimism out there, which could set up stocks for violent rebounds once those fears subside. The last time earnings revisions troughed at such a negative level turned out to be a great buying opportunity for stocks. The next one will likely prove to be one as well.

US earnings downgrades outnumber upgrades by the most since 2020

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.