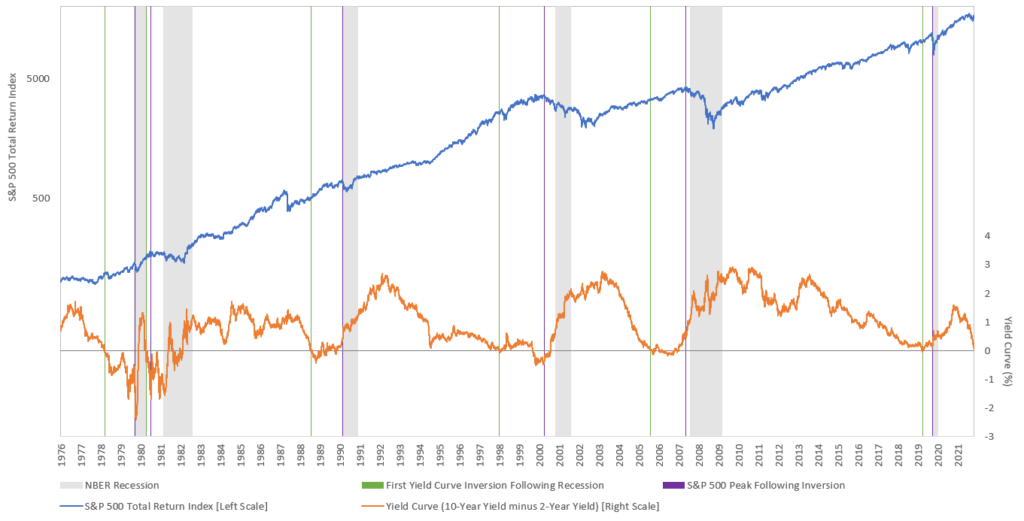

At about 1:32 PM EST on Tuesday, the widely-followed spread between 10-year and 2-year treasury yields (a.k.a. the yield curve) briefly fell to -0.002%, thus inverting (even if barely) for the first time since 2019. It then “recovered” to close the day at 0.03%, which is roughly where it is at the time of writing. We could debate whether an intra-day inversion lasting about 1 minute should formally count as an inversion, but the point is moot. Given such slim margin of safety, barring an unlikely sudden change of tune from the Fed in a dovish direction, we should expect the yield curve to invert again soon. While a sustained yield curve inversion would have ominous implications for the economy down the road, an initial yield curve inversion doesn’t mean stocks are immediately headed for a bear market, quite the opposite in fact.

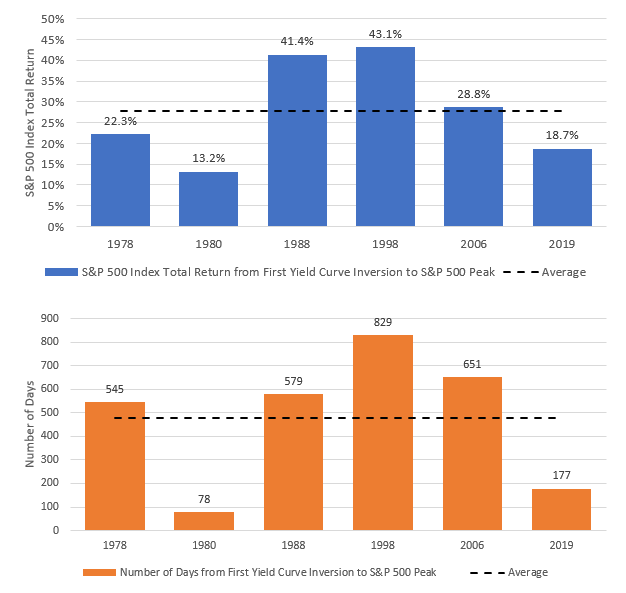

Looking back at history since the 1970s, we identified six separate cycles in which a yield curve inversion was followed by a stock market peak, which was then followed by a recession. In every single case, following the initial inversion of the yield curve, stocks went on to record double-digit gains before the bull market eventually peaked. The average gain was 28% and was achieved over an average period of 476 days (roughly 16 months). The yield curve inversion between the double-dip recessions of the early 1980s saw the smallest gains of 13%, which were also recorded over the shortest period of 78 days. At the opposite end of the spectrum, the 1998 inversion was followed by the largest gain of 43%, recorded over 829 days (over 2 years).

Every cycle is different and these numbers should not be used as an excuse to be complacent. However they do suggest that investors fleeing stocks as soon as the yield curve inverts may be leaving a lot of money on the table.

S&P 500 Total Return and Number of Days from Initial Yield Curve Inversion to S&P 500 Peak

The S&P 500 Index and the Yield Curve

Sauro Locatelli CFA, FRM™, SCR™

Director of Quantitative Research

Congress Wealth Management LLC (“Congress”) is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration does not imply a certain level of skill or training. For additional information, please visit our website at congresswealth.com or visit the Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov by searching with Congress’ CRD #310873.

This note is provided for informational purposes only. Congress believes this information to be accurate and reliable but does not warrant it as to completeness or accuracy. This note may include candid statements, opinions and/or forecasts, including those regarding investment strategies and economic and market conditions; however, there is no guarantee that such statements, opinions and/or forecasts will prove to be correct. All such expressions of opinions or forecasts are subject to change without notice. Any projections, targets or estimates are forward looking statements and are based on Congress’ research, analysis, and assumption. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. This note is not a complete analysis of all material facts respecting any issuer, industry or security or of your investment objectives, parameters, needs or financial situation, and therefore is not a sufficient basis alone on which to base an investment decision. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this note. No portion of this note is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice. Investing entails the risk of loss of principal.

Comments are closed.